Corporate governance summary of proxy votes – Fiscal year 2016-17

The Teachers’ Retirement Board has a fiduciary duty to treat proxy votes as plan assets. This activity serves our core mission of using our vote to enhance shareholder returns and improve the financial markets for all investors.

CalSTRS believes the execution of proxies is an important fundamental shareholder right, and staff always seeks to exercise our rights in a manner consistent with the interests of our beneficiaries, California public teachers. We use our proxy votes to support certain corporate directors or shareholder proposals to introduce necessary changes that will enhance the company’s long-term shareholder value.

Over the course of each year, CalSTRS anticipates voting over 7,800 proxies, with more than half of them being voted during proxy season, which occurs in the months of April, May and June.

When voting proxies, CalSTRS uses analysis and judgment in conjunction with our Corporate Governance Principles. These principles communicate what we believe are corporate governance best practices on topics such as the board of directors, auditors, executive and director compensation, compensation plans and governance structures, and serve as guidelines for our proxy voting.

CalSTRS Proxy Voting Guidelines

The following highlight CalSTRS’ proxy voting guidelines on certain issues.

Directors

CalSTRS generally votes in support of a director unless the proxy statement shows circumstances contrary to our Corporate Governance Principles.

Some circumstances that warrant a withhold vote for a director include a potential conflict of interest due to other directorships or employment, providing legal or investment banking advice, overboarding (serving on more than four public boards), poor board meeting attendance (less than 75 percent), or a lack of board independence or a lack of board diversity.

Auditors

CalSTRS will vote to ratify the independent auditors recommended by management unless the auditor provides services that we believe are a conflict of interest.

Examples of those services include consulting, investment banking support and excessive non-audit fees (greater than 30 percent of the total fees billed).

Compensation Plans

Companies provide a variety of compensation plans, such as stock option plans, restricted stock plans or employee stock purchase plans for executives, employees and nonemployee directors. Many of these compensation plans provide for the issuance of long-term incentives to attract, reward and retain key employees.

CalSTRS evaluates these compensation plans based on their design and other factors, such as the performance metrics, burn rate and dilution potential.

Say-on-Pay

CalSTRS refers to the executive compensation sections of our Corporate Governance Principles when voting the advisory vote on executive compensation, more commonly known as say-on-pay. The say-on-pay vote provides shareholders the opportunity to ratify the compensation of the named executives in the proxy.

CalSTRS generally supports the say-on-pay vote if the company demonstrates a clear alignment between performance and pay and the total executive compensation is a reasonable amount.

Mergers and Acquisitions

When CalSTRS votes for a merger or acquisition, we do so on a case-by-case basis using a total portfolio view. Some considerations are given to the strategic rationale behind the transaction, the sales process, the change in control amount, the price premium or lack of it, the market reaction and the impact on the corporate governance of the surviving entity.

Shareholder Proposals

CalSTRS votes on shareholder proposals, such as sustainability, political contributions and social issues, on a case-by-case basis using our Corporate Governance Principles.

CalSTRS may not support shareholder proposals in instances where the company has demonstrated a willingness to engage with shareholders and/or has shown improved disclosure and transparency in the reporting.

Other Issues

CalSTRS votes corporate actions or corporate governance issues, such as those related to spin-offs, incorporation, stock issuance, stock splits and charter and bylaw amendments, on a case-by-case basis.

Proxy Research

To assist staff in our proxy vote analysis, we subscribe to proxy research from vendors, such as Glass Lewis & Co., Institutional Shareholder Services, Equilar and the Sustainable Investment Institute.

Additionally, CalSTRS frequently has dialogues with corporate issuers and other relevant parties to obtain additional information or perspectives before making a proxy vote decision on key shareholder issues.

Since 2011, CalSTRS has been using the Glass Lewis proxy voting platform to vote domestic and global proxies in-house. CalSTRS uses the Glass Lewis proxy voting platform to efficiently manage our proxy voting so staff can focus on researching and analyzing contentious issues or companies that are important to us.

Corporate Governance staff also manually cast votes on S&P 500 companies as well as mergers, shareholder proposals, contested election meetings and other extraordinary vote items. Furthermore, CalSTRS is committed to disclosing our proxy votes on CalSTRS website at CalSTRS.com.

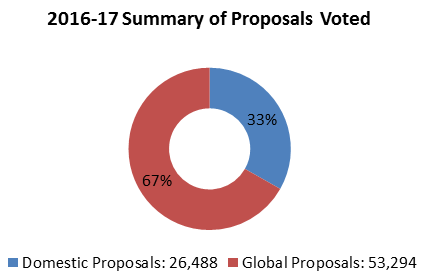

In 2016-17, CalSTRS voted on more than 79,782 proposals at 7,889 meetings held by companies in our Global Equity portfolio. The 79,782 proposals were a 3.6 percent increase from the 76,995 proposals voted in 2015-16, and the 7,889 meetings considered were slightly less than the 7,932 meetings considered in 2015-16.

Of the proposals CalSTRS voted on, 26,488 proposals were from U.S. companies and 53,294 proposals were from global companies.

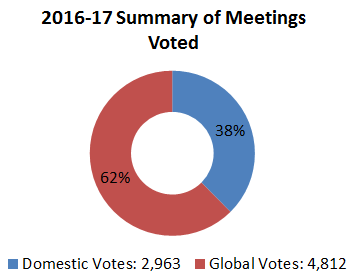

As for meetings considered, 2,963 were U.S. meetings and 4,926 were global meetings. These meetings resulted in CalSTRS voting on proposals covering a variety of topics, including direction elections, auditor ratifications, advisory vote executive compensation, compensation plans, mergers and acquisitions, and shareholder proposals.

The following charts provide a summary of the number of proposals CalSTRS voted on and the number of meetings in 2016-17.

The following chart summarizes the monthly proxies voted in 2016-17. Staff voted most of the proxies during proxy season, which occurs in the months of April, May and June.

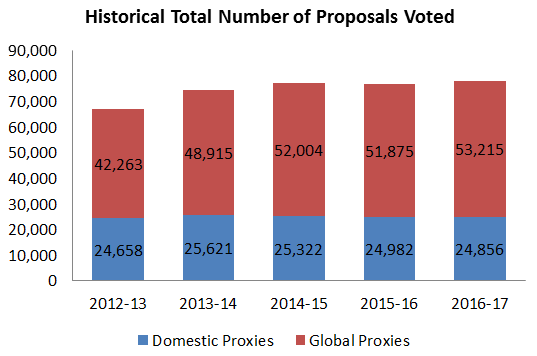

The chart below shows the total number of proposals staff voted over the past five fiscal years. The domestic proxy voting levels have generally remained fairly consistent since 2012-13.

In 2010, the Dodd-Frank Act was implemented requiring all public companies to hold an advisory vote on executive compensation (say-on-pay) vote at least once every three years. However, a provision of the Dodd-Frank Act allowed a two-year exemption for smaller reporting companies, which explained why the number of proposals voted increased slightly once the two-year exemption was phased out.

As for the global proxies, there was a gradual increase in the number of proposals voted over the years, which was primarily attributed to our hiring of new non-U.S. external managers, particularly in emerging markets in 2013.

The aggregated “For” and “Against” votes for each of the past five fiscal years are depicted in following charts. The aggregate support levels for the domestic and global proxy votes have been fairly consistent over the past five years, with the support levels being approximately 70 percent and 50 percent for domestic and global proxy votes, respectively.

Our aggregated support levels for global proxy votes consistently continued to be significantly lower than those of the domestic proxy votes; this is primarily due to our high withhold votes for the directors at public companies in the foreign markets for not meeting our board independence standards, as outlined in our Corporate Governance Principles.

In 2016-17, staff voted on 26,488 proposals at 2,963 meetings held by companies in the domestic public equity portfolio. Compared to 2015-16, the number of proposals and meetings was 5.6 percent higher and 1.6 percent lower, respectively.

The following table shows the number of proposals considered on major issues in fiscal years 2015-16 and 2016-17 and the percentage change year over year. The number of director elections, auditor ratifications and compensation plans considered remained fairly consistent year over year.

In 2016-17, the number of say-on-pay votes increased by more than 9 percent, which is likely attributable to more U.S. companies with triennial say-on-pay frequency having to put up their say-on-pay vote this year.

Issue | 2015-16 Proposals Considered | 2016-17 Proposals Considered | 2015-16 to 2016-17 Change |

|---|---|---|---|

Election of Directors | 17,347 | 17,209 | (0.8%) |

Ratification of Auditor | 2,749 | 2,669 | (2.9%) |

Say-on-Pay | 2,102 | 2,298 | 9.3% |

Equity Compensation Plan | 1,291 | 1,283 | (0.6%) |

Proxy Access | 84 | 56 | (33.3%) |

Political Activities | 78 | 73 | (6.4%) |

Environment | 87 | 79 | (9.2%) |

Historical proxy voting of certain major issues

Issue | 2012-13 Total | 2012-13 For | 2012-13 Against | 2013-14 Total | 2013-14 For | 2013-14 Against | 2014-15 Total | 2014-15 For | 2014-15 Against | 2015-16 Total | 2015-16 For | 2015-16 Against | 2016-17 Total | 2016-17 For | 2016-17 Against |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Directors | 18,444 | 66% | 34% | 17,546 | 66% | 34% | 17,531 | 68% | 32% | 17,347 | 67% | 33% | 17,209 | 71% | 29% |

Auditor Ratification | 2,954 | 91% | 9% | 2,776 | 91% | 9% | 2,800 | 92% | 8% | 2,749 | 92% | 8% | 2,669 | 92% | 8% |

Compensation Plans | 1,320 | 82% | 18% | 1,273 | 82% | 18% | 1,263 | 83% | 17% | 1,291 | 81% | 19% | 1,283 | 79% | 21% |

Say-on-Pay | 2,494 | 86% | 14% | 2,533 | 83% | 17% | 2,201 | 84% | 16% | 2,102 | 81% | 19% | 2,298 | 82% | 18% |

Mergers & Acquisitions | 151 | 96% | 4% | 130 | 98% | 2% | 160 | 99% | 1% | 176 | 94% | 6% | 208 | 99% | 1% |

As shown in the table above, the support level for incumbent directors was slightly higher compared to previous fiscal years as companies have increased their outreach or engagement efforts with us during the proxy off-season. Also, CalSTRS usually withholds from the directors on the compensation committee in instances where staff votes against the company’s equity compensation plan or say-on-pay vote.

Over the years, we have increased our engagement efforts with companies with a low support level for their equity compensation plans or say-on-pay votes. In some instances, our engagement efforts have resulted in the companies improving disclosure or modifying certain provisions to their executive compensation, which have led us to support the say-on-pay votes the following year.

Shareholder proposals

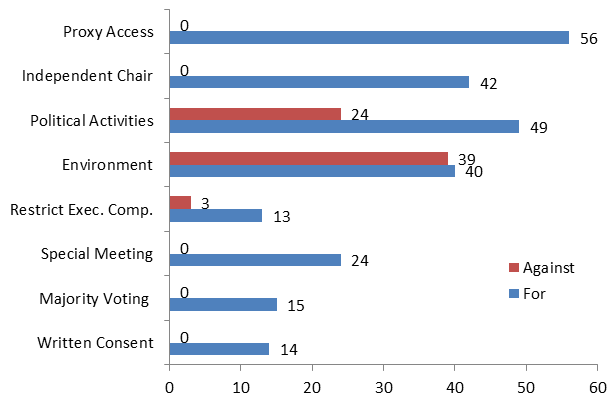

The following chart highlights how CalSTRS voted on certain major shareholder issues in 2016-17.

Environmental proposals

There was a slight decrease in the year over year number for environment proposals that CalSTRS voted.

CalSTRS supported all environment proposals requesting companies to issue a sustainability report in 2016-17.

Overall, we supported more than 50 percent of environment proposals, which included issues related to climate change, greenhouse gas emission reduction and reporting, energy efficiency and renewables, and sustainability or environmental reporting.

Generally, CalSTRS supports environmental proposals at companies that have not demonstrated transparency and adequate environmental disclosure in their reporting or are not open to engaging with shareholders on environmental issues.

Social and political proposals

Overall, the number of social proposals that CalSTRS voted remained relatively unchanged from last fiscal year, and we supported approximately 50 percent of such proposals, which included proposals on political, diversity, animal welfare, EEO reporting, and others.

As for the political proposals, the number decreased slightly in 2016-17 compared to 2015-16.

Shareholders have been requesting more information on political spending and lobbying activities from companies since the Supreme Court decision Citizens United v. Federal Election Commission allowed independent political expenditures by corporations. In response, more companies have increased their disclosure of political and lobbying expenditures.

In 2016-17, CalSTRS supported approximately two-third (67 percent) of all political proposals considered.

Generally, CalSTRS supports political proposals at companies that do not demonstrate adequate board oversight of the company’s political contributions, charitable contributions and lobbying activities and expenses, and their policy is not readily accessible to shareholders.

Governance proposals

In 2016-17, the number of traditional governance proposals that CalSTRS voted was less than last fiscal year. In fact, such proposals have decreased significantly since 2014-15, as shown in Table B.

Traditional governance proposals, such as independent chair, majority voting for director elections, the right to act by written consents and declassifying the board, were less in 2016-17 than in 2015-16.

The declining trend in these proposals may be due to the majority of the largely, established companies already adopting these best governance practices, and smaller companies being more open to voluntarily adopting these best governance practices as well.

Compensation proposals

As for compensation proposals, the number CalSTRS voted in 2016-17 was less than in 2015-16. Such a declining trend has continued since the introduction of mandatory say-on-pay vote in 2011.

For instance, in 2012-13, the number of compensation proposals restricting executive compensation was 79 while in 2016-17 it was only 16.

Companies receiving a low support level on their say-on-pay votes have been open to engaging with shareholders, therefore, compensation proposals may not be necessary means to get companies to improve their executive compensation.

Unsurprisingly, in 2016-17, we have seen an increase in the number of compensation proposals on race and/or gender pay equity reporting or reporting on the ratio between CEO and employee pay as investors have focused more on issues related to pay inequality.

Proxy access

Over the past few years, proxy access has been an important and dominant issue during the proxy season since the New York City Comptroller and the New York City pension funds launched the Boardroom Accountability Project in 2014.

Since then, more companies, mostly large established ones in the S&P 500 Index, have been accepting of proxy access and have voluntarily adopted these proposals. For that reason, the number of proxy access shareholder proposals considered was 33 percent less this fiscal year, compared to last fiscal year.

Proxy access proposals represented approximately 26 percent of the governance proposals we voted in 2016-17, which was less than the 32 percent in 2015-16.

In 2016-17, CalSTRS continued to support all 56 proxy access shareholder proposals modeled after the SEC’s original proxy access proposal, which allowed an investor or a group of investors holding an aggregate of three percent or more of the company’s shares for three or more years the right to nominate director candidates on the proxy.

CalSTRS is also a strong proponent of proxy access proposals allowing the nomination of two directors or 20 to 25 percent of the board.

The following chart summarizes the type and volume of the major shareholder proposals that CalSTRS voted on in 2016-17.

In 2016-17, staff voted on 53,294 proposals at 4,926 meetings held by companies in our non-domestic equity portfolio. Compared to 2015-16, the number of proposals and meetings was 2.7 percent higher and 0.1 percent lower, respectively.

The following table shows our votes for major issues on the global proxies for the past five fiscal years.

The aggregated “For” and “Against” votes for these major issues have remained fairly consistent over the past five fiscal years.

In 2016-17, CalSTRS continued to have a very low support of 21 percent for the directors on the public company boards in the foreign markets, which is primarily due to a lack of board independence, as specified in our Corporate Governance Principles. This is in contrast to our 71 percent support level for the directors on the public company boards in our domestic markets.

In 2016-17, we also supported only 13 percent of the shareholder proposals on the global proxies compared to the 70 percent support on the domestic proxies.

The significant difference in the support level can be attributed to the overly prescriptive or mandatory, rather than advisory, provisions associated with the shareholder proposals on the global proxies.

Issue | 2012-13 Total | 2012-13 For | 2012-13 Against | 2013-14 Total | 2013-14 For | 2013-14 Against | 2014-15 Total | 2014-15 For | 2014-15 Against | 2015-16 Total | 2015-16 For | 2015-16 Against | 2016-17 Total | 2016-17 For | 2016-17 Against |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Directors | 20,630 | 16% | 84% | 19,542 | 15% | 85% | 20,611 | 16% | 84% | 22,191 | 22% | 78% | 22,795 | 21% | 79% |

Auditor Ratification | 2,155 | 70% | 30% | 2,399 | 72% | 28% | 2,365 | 70% | 30% | 2,826 | 75% | 25% | 2,919 | 76% | 24% |

Compensation Plans | 2,395 | 78% | 22% | 3,141 | 72% | 28% | 3,251 | 73% | 27% | 3,664 | 71% | 29% | 3,507 | 72% | 28% |

Advisory Vote on Exec. Comp./Comp. Policy | 1,104 | 65% | 35% | 1,666 | 79% | 21% | 1,607 | 81% | 19% | 1,692 | 76% | 24% | 2,193 | 78% | 22% |

Mergers & Acquisitions | 401 | 89% | 11% | 296 | 95% | 5% | 316 | 97% | 3% | 346 | 93% | 7% | 303 | 96% | 4% |

The following chart shows the number of meeting votes per region.

The following graph depicts the number of proxies voted by region over the past five fiscal years.

As shown in the chart, the number of global votes has been fairly consistent over the past four years. There was a significant increase from 2012-13 to 2013-14, which was due to our hiring of new emerging markets, particularly in the Europe and Asia ex-Japan regions.

For fiscal year 2017-18, CalSTRS will continue to vote our proxies in accordance with our Corporate Governance Principles and in a manner that aligns with the interests of our beneficiaries, California public teachers.

Overall, we believe the market has shown improved governances as many large companies have adopted governance best practices, such as proxy access, and are engaging shareholders on various issues, including executive compensation, board composition, and ESG issues during the proxy off-season.

However, there are companies that continue to have excessive executive compensation and poor governance practices that our diminish shareholder rights. CalSTRS will continue to use our proxy votes to support certain corporate directors, corporate actions and shareholder proposals at the companies to improve their governance and enhance their long-term shareholder value.