Employer audits

The CalSTRS employer audits process is designed to promote accurate reporting of payroll information used to calculate benefits for our members. This important process is one way in which CalSTRS ensures correct benefits are paid and the fund is protected for our members.

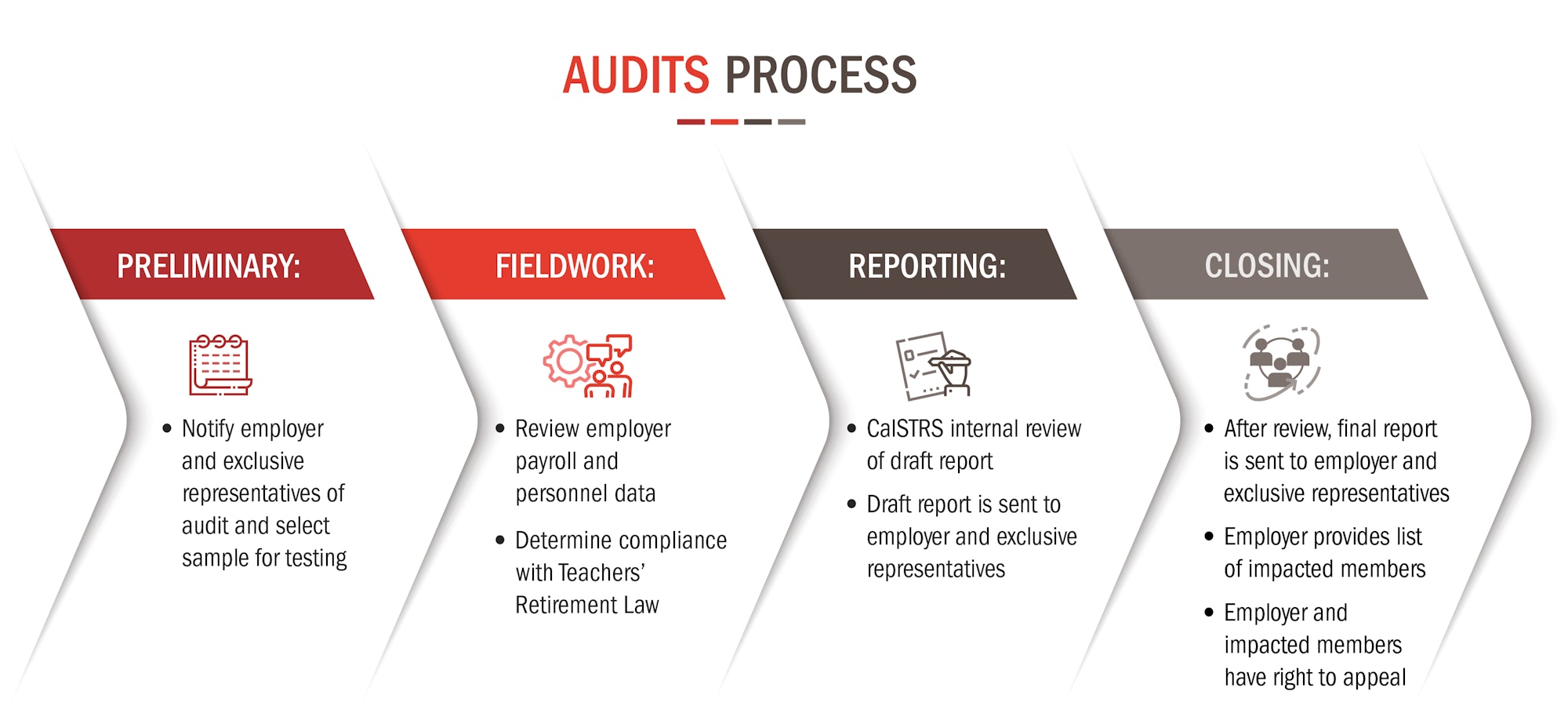

When an employer is audited by CalSTRS, a sample of member accounts is reviewed to determine if the employer’s payroll reporting is in compliance with the Teachers’ Retirement Law. When the audit is complete, a draft audit report will be provided to both the employer and exclusive representatives who will have 60 days to review and respond to the draft audit report. This allows the employer and exclusive representatives to provide further information or documentation to CalSTRS to review prior to issuing the final audit report.

After the final report is issued, the employer will have 60 days to submit a list to CalSTRS of all impacted members who are affected by the findings. All impacted members will be contacted by CalSTRS with information regarding the finding and their appeal rights. CalSTRS then works with the employer to ensure the member data is reported correctly and then provides education on how to report accurately in the future.

To receive a notification when new audits are available, subscribe to email updates. Subscribers are responsible for updating their contact information for emailed resources.

The List of Potential Employers for 2023 Audits includes the names of employers that were selected as part of our annual risk assessment for potential audits during the 2023 calendar year. This list may be updated as employers are added or removed from the list. Pursuant to Education Code section 22206.5. You can find recently completed final audit reports below.

Final audit reports completed prior to January 1, 2023 are available by public record request. Written requests for copies of final audit reports may be transmitted by email to Compliance@CalSTRS.com or sent to the following mailing address:

CalSTRS

Office of General Counsel

100 Waterfront Place, MS #3

West Sacramento, CA 95605

| Employer | Report date | Findings | Report |

|---|---|---|---|

| Long Beach Community College District | 11/26/2024 | 2 | [Download](https://www.calstrs.com/files/6ea0b19e9/EA24-26LongBeachCommunityCollegeDistrictFinalReport.pdf) |

| San Joaquin County Office of Education | 11/26/2024 | 0 | [Download](https://www.calstrs.com/files/2cd7e3e4d/EA25-10SanJoaquinOfficeofEducationFinalReport.pdf) |

| Jurupa Unified School District | 11/22/2024 | 3 | [Download](https://www.calstrs.com/files/4608fe9f6/EA24-22JurupaUnifiedSchoolDistrictFinalReport.pdf) |

| El Monte Union High School District | 11/22/2024 | 0 | [Download](https://www.calstrs.com/files/77c1cdb58/EA24-51ElMonteUnionHighSchoolDistrictFinalReport.pdf) |

| Desert Community College District | 11/20/2024 | 3 | [Download](https://www.calstrs.com/files/11e358e01/EA24-78DesertCommunityCollegeDistrictFinalReport.pdf) |

| Travis Unified School District | 11/20/2024 | 3 | [Download](https://www.calstrs.com/files/196d131e9/EA23-102TravisUnifiedSchoolDistrictFinalReport.pdf) |

| Encinitas Union School District | 11/20/2024 | 0 | [Download](https://www.calstrs.com/files/ba20e554b/EA25-18EncinitasUnionSchoolDistrictFinalReport.pdf) |

| Kingsburg Elementary Charter School District | 11/18/2024 | 0 | [Download](https://www.calstrs.com/files/bd561086a/EA25-29KingsburgElementaryCharterSchoolDistrictFinalReport.pdf) |

| Los Angeles County Office of Education | 11/14/2024 | 1 | [Download](https://www.calstrs.com/files/a6a7428c8/EA24-38LosAngelesCountyOfficeofEducationFinalReport.pdf) |

| San Diego Community College District | 11/14/2024 | 1 | [Download](https://www.calstrs.com/files/369631ccd/EA24-05SanDiegoCommunityCollegeDistrictFinalReport.pdf) |

| Lakeside Union School District | 11/12/2024 | 4 | [Download](https://www.calstrs.com/files/285ad2775/EA24-32LakesideUnionSchoolDistrictFinalReport.pdf) |

| Lucia Mar Unified School District | 11/12/2024 | 1 | [Download](https://www.calstrs.com/files/5ad334771/EA24-46LuciaMarUnifiedSchoolDistrictFinalReport.pdf) |

| Brawley Union High School District | 11/12/2024 | 0 | [Download](https://www.calstrs.com/files/75748f79f/EA25-09BrawleyUnionHighSchoolDistrictFinalReport.pdf) |

| Lucia Mar Unified School District | 11/7/2024 | 1 | [Download](https://www.calstrs.com/files/e6c4ddb9d/EA24-47LuciaMarUnifiedSchoolDistrictFinalReport.pdf) |

| Conejo Valley Unified School District | 11/7/2024 | 0 | [Download](https://www.calstrs.com/files/0ef47ad72/EA25-15ConejoValleyUnifiedSchoolDistrictFinalReport.pdf) |

| Santa Rosa City Schools District | 11/5/2024 | 1 | [Download](https://www.calstrs.com/files/2bec4cbea/EA23-74SantaRosaCitySchoolsDistrictFinalReport.pdf) |

| ABC Unified School District | 10/31/2024 | 3 | [Download](https://www.calstrs.com/files/8c899b6a8/EA23-90ABCUnifiedSchoolDistrictFinalReport.pdf) |

| Menlo Park City School District | 10/29/2024 | 2 | [Download](https://www.calstrs.com/files/a5e9c96a7/EA23-106MenloParkCitySchoolDistrictFinalReport.pdf) |

| Menlo Park City School District | 10/29/2024 | 1 | [Download](https://www.calstrs.com/files/88e094f40/EA23-80MenloParkCitySchoolDistrictFinalReport.pdf) |

| Lakeport Unified School District | 10/23/2024 | 4 | [Download](https://www.calstrs.com/files/faaa25901/EA24-25LakeportUnifiedSchoolDistrictFinalReport.pdf) |

| Brentwood Union Elementary | 10/23/2024 | 0 | [Download](https://www.calstrs.com/files/dfed4827a/EA25-19BrentwoodUnionSchoolDistrictFinalReport.pdf) |

| Alliance College-Ready Middle Academy #8 | 10/21/2024 | 7 | [Download](https://www.calstrs.com/files/545ef7d7d/EA19-57AllianceCollege-ReadyMiddleAcademy8FinalReport.pdf) |

| Palmdale Elementary School District | 10/17/2024 | 6 | [Download](https://www.calstrs.com/files/9f7d8820e/EA24-03PalmdaleElementarySchoolDistrictFinalReport.pdf) |

| Palmdale Elementary School District | 10/17/2024 | 1 | [Download](https://www.calstrs.com/files/482a09808/EA24-14PalmdaleElementarySchoolDistrictFinalReport.pdf) |

| San Mateo County Office of Education | 10/14/2024 | 3 | [Download](https://www.calstrs.com/files/6d569dc7c/EA23-97SanMateoCountyOfficeofEducationFinalReport.pdf) |

| Ohlone Community College District | 10/14/2024 | 1 | [Download](https://www.calstrs.com/files/f24feadd0/EA24-30OhloneCommunityCollegeDistrictFinalReport.pdf) |

| Buckeye Union School District | 10/9/2024 | 0 | [Download](https://www.calstrs.com/files/a3dc3d3e6/EA25-16BuckeyeUnionSchoolDistrictFinalReport.pdf) |

| San Marcos Unified School District | 10/7/2024 | 1 | [Download](https://www.calstrs.com/files/0556a5be9/EA24-39SanMarcosUnifiedSchoolDistrictFinalReport.pdf) |

| Mariposa County Unified School District | 9/30/2024 | 1 | [Download](https://www.calstrs.com/files/34c7a1de3/EA24-34MariposaCountyUnifiedSchoolDistrictFinalReport.pdf) |

| Sequoia Union High School District | 9/30/2024 | 1 | [Download](https://www.calstrs.com/files/f688e8518/EA24-07SequoiaUnionHighSchoolDistrictFinalReport.pdf) |

| Norwalk-La Mirada Unified School District | 9/30/2024 | 0 | [Download](https://www.calstrs.com/files/0bcc00dea/EA24-31Norwalk-LaMiradaUnifiedSchoolDistrictFinalReport.pdf) |

| Dry Creek Joint Elementary School District | 9/26/2024 | 0 | [Download](https://www.calstrs.com/files/ad565ffc6/EA24-58DryCreekJointElementarySchoolDistrictFinalReport.pdf) |

| Foothill-De Anza Community College District | 9/24/2024 | 1 | [Download](https://www.calstrs.com/files/27f0e2a8a/EA24-17Foothill-DeAnzaCommunityCollegeDistrictFinalReport.pdf) |

| Imperial County Office of Education | 9/24/2024 | 1 | [Download](https://www.calstrs.com/files/479725149/EA24-16ImperialCountyOfficeofEducationFinalReport.pdf) |

| Placentia-Yorba Linda Unified School District | 9/18/2024 | 3 | [Download](https://www.calstrs.com/files/52e5eabab/EA24-33Placentia-YorbaLindaUnifiedSchoolDistrictFinalReport.pdf) |

| REACH Leadership STEAM Academy | 9/5/2024 | 1 | [Download](https://www.calstrs.com/files/dc131b0cf/EA24-23REACHLeadershipSTEAMAcademyFinalReport.pdf) |

| Ocean View School District | 8/29/2024 | 0 | [Download](https://www.calstrs.com/files/dfed345d3/EA24-63OceanViewSchoolDistrictFinalReport.pdf) |

| Bakersfield City School District | 8/27/2024 | 1 | [Download](https://www.calstrs.com/files/9239c6516/EA23-03BakersfieldCitySchoolDistrictFinalReport.pdf) |

| Kern Union High School District | 8/27/2024 | 0 | [Download](https://www.calstrs.com/files/8a64fc540/EA24-43KernUnionHighSchoolDistrictFinalReport.pdf) |

| Colton Joint Unified School District | 8/20/2024 | 2 | [Download](https://www.calstrs.com/files/f50de4c2c/EA23-77ColtonJointUnifiedSchoolDistrictFinalReport.pdf) |

| Ventura County Office of Education | 8/20/2024 | 0 | [Download](https://www.calstrs.com/files/71fe0de16/EA24-54VenturaCountyOfficeofEducationFinalReport.pdf) |

| Empire Springs Charter School | 8/8/2024 | 1 | [Download](https://www.calstrs.com/files/4d82d0c71/EA23-107EmpireSpringsCharterSchoolFinalReport.pdf) |

| Foothill-De Anza Community College District | 8/6/2024 | 0 | [Download](https://www.calstrs.com/files/691da2fec/EA24-45Foothill-DeAnzaCommunityCollegeDistrictFinalReport.pdf) |

| San Leandro Unified School District | 7/31/2024 | 3 | [Download](https://www.calstrs.com/files/951b76ee2/EA24-15SanLeandroUnifiedSchoolDistrictFinalReport.pdf) |

| Charter of Morgan Hill | 7/31/2024 | 1 | [Download](https://www.calstrs.com/files/eaa13700e/EA23-86CharterofMorganHillFinalReport.pdf) |

| Rialto Unified School District | 7/18/2024 | 1 | [Download](https://www.calstrs.com/files/89be2f9aa/EA23-78RialtoUnifiedSchoolDistrictFinalReport.pdf) |

| Robla School District | 7/15/2024 | 2 | [Download](https://www.calstrs.com/files/59af1091e/EA23-79RoblaSchoolDistrictFinalReport.pdf) |

| Santa Ana Unified School District | 7/15/2024 | 2 | [Download](https://www.calstrs.com/files/cedbca886/EA23-89SantaAnaUnifiedSchoolDistrictFinalReport.pdf) |

| Montebello Unified School District | 7/9/2024 | 2 | [Download](https://www.calstrs.com/files/33eb667fc/EA23-94MontebelloUnifiedSchoolDistrictFinalReport.pdf) |

| Oakland Unified School District | 7/5/2024 | 2 | [Download](https://www.calstrs.com/files/8c5e78897/EA23-50OaklandUnifiedSchoolDistrictFinalReport.pdf) |

| Lynwood Unified School District | 6/26/2024 | 1 | [Download](https://www.calstrs.com/files/f1f930961/EA23-76LynwoodUnifiedSchoolDistrictFinalReport.pdf) |

| Enterprise Elementary School District | 6/20/2024 | 3 | [Download](https://www.calstrs.com/files/24406ab75/EA23-87EnterpriseElementarySchoolDistrictFinalReport.pdf) |

| Downey Unified School District | 6/20/2024 | 1 | [Download](https://www.calstrs.com/files/66383f288/EA23-88DowneyUnifiedSchoolDistrictFinalReport.pdf) |

| Mountain Empire Unified School District | 6/20/2024 | 1 | [Download](https://www.calstrs.com/files/f093f782c/EA23-98MountainEmpireUnifiedSchoolDistrictFinalReport.pdf) |

| Gorman Learning Center | 6/18/2024 | 3 | [Download](https://www.calstrs.com/files/a6ac06822/EA23-66GormanLearningCenterFinalReport.pdf) |

| Grass Valley Elementary School District | 6/18/2024 | 0 | [Download](https://www.calstrs.com/files/0408af514/EA24-28GrassValleyElementarySchoolDistrictFinalReport.pdf) |

| Voices College-Bound Academy | 6/14/2024 | 2 | [Download](https://www.calstrs.com/files/bd624113e/EA23-54VoicesCollege-BoundAcademyFinalReport.pdf) |

| Loomis Union Elementary School District | 6/14/2024 | 1 | [Download](https://www.calstrs.com/files/f1308bcfc/EA23-108LoomisUnionElementarySchoolDistrictFinalReport.pdf) |

| Panama-Buena Vista Union School District | 6/5/2024 | 1 | [Download](https://www.calstrs.com/files/c09144ffb/EA23-101Panama-BuenaVistaUnionSchoolDistrictFinalReport.pdf) |

| Azusa Unified School District | 5/31/2024 | 4 | [Download](https://www.calstrs.com/files/d8cc01612/EA23-67AzusaUnifiedSchoolDistrictFinalReport.pdf) |

| School of Arts and Enterprise | 5/31/2024 | 1 | [Download](https://www.calstrs.com/files/5c571180e/EA23-103SchoolofArtsandEnterpriseFinalReport.pdf) |

| Morgan Hill Unified School District | 5/28/2024 | 0 | [Download](https://www.calstrs.com/files/fc3348298/EA23-110MorganHillUnifiedSchoolDistrictFinalReport.pdf) |

| Escondido Union School District | 5/24/2024 | 2 | [Download](https://www.calstrs.com/files/ef0ecc1c3/EA23-96EscondidoUnionHighSchoolDistrictFinalReport.pdf) |

| Sequoia Union High School District | 5/24/2024 | 0 | [Download](https://www.calstrs.com/files/71fc73472/EA24-08SequoiaUnionHighSchoolDistrictFinalReport.pdf) |

| Burbank Unified School District | 5/22/2024 | 2 | [Download](https://www.calstrs.com/files/317b18053/EA23-02BurbankUnifiedSchoolDistrictFinalReport.pdf) |

| Colusa Unified School District | 5/22/2024 | 0 | [Download](https://www.calstrs.com/files/c8ea405b5/EA24-29ColusaUnifiedSchoolDistrictFinalReport.pdf) |

| Newport-Mesa Unified School District | 5/22/2024 | 0 | [Download](https://www.calstrs.com/files/76fd7a212/EA24-06Newport-MesaUnifiedSchoolDistrictFinalReport.pdf) |

| Upper Lake Unified School District | 5/13/2024 | 0 | [Download](https://www.calstrs.com/files/4403b21f1/EA24-24UpperLakeUnifiedSchoolDistrictFinalReport.pdf) |

| Robla School District | 5/9/2024 | 2 | [Download](https://www.calstrs.com/files/5c0be2e2c/EA23-84RoblaSchoolDistrictFinalReport.pdf) |

| Alvord Unified School District | 5/9/2024 | 1 | [Download](https://www.calstrs.com/files/30d0b2b8f/EA23-99AlvordUnifiedSchoolDistrictFinalReport.pdf) |

| William S. Hart Union High School District | 4/30/2024 | 0 | [Download](https://www.calstrs.com/files/0be98e3ec/EA24-04WilliamSHartUnionHighSchoolDistrictFinalReport.pdf) |

| Konocti Unified School District | 4/16/2024 | 2 | [Download](https://www.calstrs.com/files/d9f247434/EA23-38KonoctiUnifiedSchoolDistrictFinalReport.pdf) |

| Lake Tahoe Unified School District | 4/16/2024 | 1 | [Download](https://www.calstrs.com/files/e8c392b2e/EA23-82LakeTahoeUnifiedSchoolDistrictFinalReport.pdf) |

| The Cottonwood School District | 4/12/2024 | 3 | [Download](https://www.calstrs.com/files/97d97d96f/EA21-12TheCottonwoodSchoolDistrictFinalReport.pdf) |

| Fresno County Superintendent of Schools (Office of Education) | 4/10/2024 | 1 | [Download](https://www.calstrs.com/files/8c5a0d393/EA23-85FresnoCountySuperintendentofSchoolsFinalReport.pdf) |

| San Jacinto Unified School District | 4/8/2024 | 0 | [Download](https://www.calstrs.com/files/e6c5f2020/EA24-13SanJacintoUnifiedSchoolDistrictFinalReport.pdf) |

| Fallbrook Union Elementary School District | 4/4/2024 | 2 | [Download](https://www.calstrs.com/files/51965bc20/EA23-70FallbrookUnionElementarySchoolDistrictFinalReport.pdf) |

| Fowler Unified School District | 4/4/2024 | 1 | [Download](https://www.calstrs.com/files/0db064402/EA22-92FowlerUnifiedSchoolDistrictFinalReport.pdf) |

| San Joaquin Delta Community College District | 3/27/2024 | 0 | [Download](https://www.calstrs.com/files/c97975672/EA24-02SanJoaquinCommunityCollegeDistrictFinalReport.pdf) |

| Visalia Unified School District | 3/25/2024 | 2 | [Download](https://www.calstrs.com/files/67a25affc/EA23-59VisaliaUnifiedSchoolDistrictFinalReport.pdf) |

| Napa Valley Unified School Disitrct | 3/20/2024 | 0 | [Download](https://www.calstrs.com/files/50640d68c/EA24-01NapaValleyUnifiedSchoolDistrictFinalReport.pdf) |

| Centinela Valley Union High School District | 3/14/2024 | 1 | [Download](https://www.calstrs.com/files/5bf08683e/EA23-71CentinelaValleyUnionHighSchoolDistrictFinalReport.pdf) |

| New Haven Unified School District | 3/8/2024 | 1 | [Download](https://www.calstrs.com/files/a77ce3007/EA23-64NewHavenUnifiedSchoolDistrictFinalReport.pdf) |

| Del Mar Union School District | 3/8/2024 | 0 | [Download](https://www.calstrs.com/files/d773fe51b/EA23-91DelMarUnionSchoolDistrictFinalReport.pdf) |

| Oceanside Unified School District | 3/6/2024 | 2 | [Download](https://www.calstrs.com/files/1aeff4d74/EA23-41OceansideUnifiedSchoolDistrictFinalReport.pdf) |

| Wilsona Elementary School District | 3/6/2024 | 2 | [Download](https://www.calstrs.com/files/7f024bd01/EA23-49WilsonaElementarySchoolDistrictFinalReport.pdf) |

| Escondido Union High School District | 3/6/2024 | 1 | [Download](https://www.calstrs.com/files/78f292ee1/EA23-75EscondidoUnionHighSchoolDistrictFinalReport.pdf) |

| Gilroy Unified School District | 3/4/2024 | 3 | [Download](https://www.calstrs.com/files/8bfae1299/EA23-53GilroyUnifiedSchoolDistrictFinalReport.pdf) |

| STREAM Charter School | 2/28/2024 | 2 | [Download](https://www.calstrs.com/files/8b9a17568/EA23-56STREAMCharterSchoolFinalReport.pdf) |

| San Carlos Charter Learning Center | 2/28/2024 | 2 | [Download](https://www.calstrs.com/files/7e6614721/EA22-107SanCarlosCharterLearningCenterFinalReport.pdf) |

| Compass Charter Schools | 2/28/2024 | 2 | [Download](https://www.calstrs.com/files/dada16919/EA22-81CompassCharterSchoolsFinalReport.pdf) |

| Ventura County Community College District | 2/23/2024 | 2 | [Download](https://www.calstrs.com/files/6d6377b96/EA23-69VenturaCountyCommunityCollegeDistrictFinalReport.pdf) |

| Chino Valley Unified School District | 2/23/2024 | 2 | [Download](https://www.calstrs.com/files/0e3755d52/EA23-63ChinoValleyUnifiedSchoolDistrictFinalReport.pdf) |

| West Contra Costa Unified School District | 2/16/2024 | 7 | [Download](https://www.calstrs.com/files/cabb08748/EA21-92WestContraCostaUnifiedSchoolDistrictFinalReport.pdf) |

| Monterey Peninsula Unified School District | 2/6/2024 | 2 | [Download](https://www.calstrs.com/files/1a34427c4/EA23-39MontereyPeninsulaUnifiedSchoolDistrictFinalReport.pdf) |

| Mojave Unified School District | 2/6/2024 | 1 | [Download](https://www.calstrs.com/files/fdad57727/EA22-114MojaveUnifiedSchoolDistrictFinalReport.pdf) |

| Tracy Unified School District | 2/1/2024 | 2 | [Download](https://www.calstrs.com/files/47b846278/EA23-46TracyUnifiedSchoolDistrictFinalReport.pdf) |

| Los Banos Unified School District | 2/1/2024 | 0 | [Download](https://www.calstrs.com/files/c1a566424/EA23-04LosBanosUnifiedSchoolDistrictFinalReport.pdf) |

| NOVA Academy Coachella | 1/30/2024 | 2 | [Download](https://www.calstrs.com/files/ff2cc0dc2/EA23-44NOVAAcademyCoachellaFinalReport.pdf) |

| Palo Alto Unified School District | 1/30/2024 | 0 | [Download](https://www.calstrs.com/files/8ed31fe98/EA23-93PaloAltoUnifiedSchoolDistrictFinalReport.pdf) |

| Capitol Collegiate Academy | 1/29/2024 | 8 | [Download](https://www.calstrs.com/files/aab777cf2/EA23-32CapitolCollegiateAcademyFinalReport.pdf) |

| Pacific Springs Charter School | 1/29/2024 | 2 | [Download](https://www.calstrs.com/files/f7641512b/EA23-18PacificSpringsCharterSchoolFinalReport.pdf) |

| Pajaro Valley Unified School District | 1/26/2024 | 1 | [Download](https://www.calstrs.com/files/d64e0945b/EA23-73PajaroValleyUnifiedSchoolDistrictFinalReport.pdf) |

| Santa Clara County Office of Education | 1/26/2024 | 0 | [Download](https://www.calstrs.com/files/03b5db77d/EA23-55SantaClaraCountyOfficeofEducationFinalReport.pdf) |

| Feather River Charter School | 1/24/2024 | 3 | [Download](https://www.calstrs.com/files/fc264d6e1/EA22-82FeatherRiverCharterSchoolFinalReport.pdf) |

| Arise High School | 1/16/2024 | 1 | [Download](https://www.calstrs.com/files/e78d918fb/EA23-33AriseHighSchoolFinalReport.pdf) |

| Hanford Elementary School District | 1/16/2024 | 1 | [Download](https://www.calstrs.com/files/dacc85804/EA22-91HanfordElementarySchoolDistrictFinalReport.pdf) |

| San Ramon Valley Unified School District | 1/16/2024 | 1 | [Download](https://www.calstrs.com/files/9eb76b72c/EA23-52SanRamonValleyUnifiedSchoolDistrictFinalReport.pdf) |

| Southern Kern Unified School District | 1/12/2024 | 2 | [Download](https://www.calstrs.com/files/4dfe6cc17/EA23-51SouthernKernUnifiedSchoolDistrictFinalReport.pdf) |

| Sunnyvale School District | 1/12/2024 | 0 | [Download](https://www.calstrs.com/files/2bcc281df/EA23-40SunnyvaleSchoolDistrictFinalReport.pdf) |

| iLead Innovation Studios | 1/10/2024 | 3 | [Download](https://www.calstrs.com/files/30fce0745/EA22-105iLeadInnovationStudiosFinalReport.pdf) |

| San Gabriel Valley Regional Occupational Program | 1/10/2024 | 2 | [Download](https://www.calstrs.com/files/f01321bb1/EA23-21SanGabrielValleyRegionalOccupationalProgramFinalReport.pdf) |

| Valley Center-Pauma Unified School District | 1/10/2024 | 1 | [Download](https://www.calstrs.com/files/b918d673a/EA23-29ValleyCenter-PaumaUnifiedSchoolDistrictFinalReport.pdf) |

| Sanger Unified School District | 1/4/2024 | 1 | [Download](https://www.calstrs.com/files/6cc82e3b4/EA23-48SangerUnifiedSchoolDistrictFinalReport.pdf) |

| Corning Union Elementary School District | 1/4/2024 | 0 | [Download](https://www.calstrs.com/files/85236348a/EA23-92CorningUnionElementarySchoolDistrictFinalReport.pdf) |

| Employer | Report date | Findings | Report |

|---|---|---|---|

| Salinas City Elementary School District | 11/29/2023 | 4 | [Download](https://www.calstrs.com/files/2f56b0cb1/EA22-111SalinasCityElementarySchoolDistrictFinalReport.pdf) |

| Lake View Charter School | 11/29/2023 | 2 | [Download](https://www.calstrs.com/files/6f40c5960/EA22-108LakeViewCharterSchoolFinalReport.pdf) |

| Val Verde Unified School District | 11/29/2023 | 0 | [Download](https://www.calstrs.com/files/73dc61e6e/EA23-81ValVerdeUnifiedSchoolDistrictFinalReport.pdf) |

| Coachella Valley Unified School District | 11/27/2023 | 2 | [Download](https://www.calstrs.com/files/3b66e515f/EA23-23CoachellaValleyUnifiedSchoolDistrictFinalReport.pdf) |

| John Swett Unified School District | 11/27/2023 | 2 | [Download](https://www.calstrs.com/files/05816709e/EA23-14JohnSwettUnifiedSchoolDistrictFinalReport.pdf) |

| Tulare Joint Union High School District | 11/27/2023 | 1 | [Download](https://www.calstrs.com/files/3b7eb9da8/EA23-16TulareJointUnionHighSchoolDistrictFinalReport.pdf) |

| Sunol Glen Unified School District | 11/20/2023 | 4 | [Download](https://www.calstrs.com/files/0751438a9/EA23-15SunolGlenUnifiedSchoolDistrictFinalReport.pdf) |

| Vacaville Unified School District | 11/20/2023 | 1 | [Download](https://www.calstrs.com/files/1bb386701/EA23-22VacavilleUnifiedSchoolDistrictFinalreport.pdf) |

| Mt. Diablo Unified School District | 11/16/2023 | 4 | [Download](https://www.calstrs.com/files/97c1f65f7/EA23-26Mt.DiabloUnifiedSchoolDistrictFinalReport.pdf) |

| Plumas Unified School District | 11/16/2023 | 2 | [Download](https://www.calstrs.com/files/19f2a0b5f/EA23-47PlumasUnifiedSchoolDistrictFinalReport.pdf) |

| Martinez Unified School District | 11/14/2023 | 2 | [Download](https://www.calstrs.com/files/ea069b5c3/EA22-97MartinezUnifiedSchoolDistrictFinalReport.pdf) |

| Orchard School District | 11/14/2023 | 2 | [Download](https://www.calstrs.com/files/de058286d/EA21-74OrchardSchoolDistrictFinalReport.pdf) |

| Vista Unified School District | 11/13/2023 | 1 | [Download](https://www.calstrs.com/files/85cd6d20a/FR-EA23-25VistaUnifiedSchoolDistrictFinalReport.pdf) |

| Orcutt Union School District | 11/13/2023 | 0 | [Download](https://www.calstrs.com/files/c8839a8d5/EA23-65OrcuttUnionSchoolDistrictFinalReport.pdf) |

| Farmersville Unified School District | 11/6/2023 | 4 | [Download](https://www.calstrs.com/files/0e439bcb5/EA22-112FarmersvilleUnifiedSchoolDistrictFinalReport.pdf) |

| Shasta-Tehama-Trinity Joint Community College District | 11/6/2023 | 3 | [Download](https://www.calstrs.com/files/d1fba2a23/EA22-30Shasta-Tehama-TrinityJointCommunityCollegeDistrictFinalReport.pdf) |

| Lammersville Unified School District | 11/6/2023 | 3 | [Download](https://www.calstrs.com/files/93dd47e86/EA23-37LammersvilleUnifiedSchoolDistrictFinalReport.pdf) |

| Pajaro Valley Unified School District | 11/6/2023 | 0 | [Download](https://www.calstrs.com/files/33d3744ca/EA23-72PajaroValleyUnifiedSchoolDistrictFinalReport.pdf) |

| Bullis Charter School | 10/30/2023 | 6 | [Download](https://www.calstrs.com/files/a69cc78c6/EA21-112BullisCharterSchoolFinalReport.pdf) |

| South Whittier School District | 10/30/2023 | 3 | [Download](https://www.calstrs.com/files/35b1be248/EA22-83SouthWhittierSchoolDistrictFinalReport.pdf) |

| TEAM Charter Schools | 10/30/2023 | 2 | [Download](https://www.calstrs.com/files/a65d027fe/EA22-99TEAMCharterSchoolsFinalReport.pdf) |

| Firebaugh- Las Deltas Unified School District | 10/23/2023 | 5 | [Download](https://www.calstrs.com/files/40179c696/EA22-93Firebaugh-LasDeltasUnifiedSchoolDistrictFinalReport.pdf) |

| Knightsen Elementary School District | 10/23/2023 | 2 | [Download](https://www.calstrs.com/files/2bbc11716/EA23-31KnightsenElementarySchoolDistrictFinalReport.pdf) |

| Kern Community College District | 10/23/2023 | 1 | [Download](https://www.calstrs.com/files/d283356b5/EA22-33KernCommunityCollegeDistrictFinalReport.pdf) |

| Elk Grove Unified School District | 10/23/2023 | 0 | [Download](https://www.calstrs.com/files/07e1ad9e3/EA23-62ElkGroveUnifiedSchoolDistrictFinalReport.pdf) |

| Allan Hancock Joint Community College District | 10/23/2023 | 0 | [Download](https://www.calstrs.com/files/d6e99568a/EA23-57AllanHancockJointCommunityCollegeDistrictFinalReport.pdf) |

| Evergreen School District | 10/18/2023 | 2 | [Download](https://www.calstrs.com/files/1b531d034/EA23-35EvergreenSchoolDistrictFinalReport.pdf) |

| Pomona Unified School District | 10/13/2023 | 4 | [Download](https://www.calstrs.com/files/4b227770c/EA22-100PomonaUnifiedSchoolDistrictFinalReport.pdf) |

| Campbell Union School District | 10/6/2023 | 1 | [Download](https://www.calstrs.com/files/30050c831/EA23-34CampbellUnionSchoolDistrictFinalReport.pdf) |

| Rocklin Unified School District | 10/6/2023 | 0 | [Download](https://www.calstrs.com/files/9e38f258e/EA23-61RocklinUnifiedSchoolDistrictFinalReport.pdf) |

| Acalanes Union High School District | 9/29/2023 | 0 | [Download](https://www.calstrs.com/files/fa75f4fc0/EA21-93AcalanesUnionHighSchoolDistrictFinalReport.pdf) |

| Gateway Community Charters | 9/29/2023 | 0 | [Download](https://www.calstrs.com/files/afe074128/EA23-60GatewayCommunityChartersFinalReport.pdf) |

| Monterey Peninsula Unified School District | 9/29/2023 | 0 | [Download](https://www.calstrs.com/files/66afc1b3b/EA23-43MontereyPeninsulaUnifiedSchoolDistrict.pdf) |

| Cabrillo Community College District | 9/28/2023 | 5 | [Download](https://www.calstrs.com/files/04e51055d/EA22-38CabrilloCommunityCollegeDistrictFinalReport.pdf) |

| Liberty Union High School District | 9/28/2023 | 4 | [Download](https://www.calstrs.com/files/241a72e66/EA21-94LibertyUnionHighSchoolDistrictFinalReport.pdf) |

| Natomas Unified School District | 9/28/2023 | 4 | [Download](https://www.calstrs.com/files/4f7a52f01/EA23-11NatomasUnifiedSchoolDistrictFinalReport.pdf) |

| Lynwood Unified School District | 9/28/2023 | 2 | [Download](https://www.calstrs.com/files/3dab003de/EA23-10LynwoodUnifiedSchoolDistrictFinalReport.pdf) |

| Palo Verde Community College District | 9/28/2023 | 1 | [Download](https://www.calstrs.com/files/7da4cd404/EA22-84PaloVerdeCommunityCollegeDistrictFinalReport.pdf) |

| Oakland Unified School District | 9/15/2023 | 9 | [Download](https://www.calstrs.com/files/714000cb2/EA22-27OaklandUnifiedSchoolDistrictFinalReport.pdf) |

| Century Community Charter School | 9/15/2023 | 3 | [Download](https://www.calstrs.com/files/7f637ebe4/EA23-12CenturyCommunityCharterSchoolFinalReport.pdf) |

| Da Vinci Science Charter School | 9/15/2023 | 3 | [Download](https://www.calstrs.com/files/b42d14e68/EA23-13DaVinciScienceCharterSchoolFinalReport.pdf) |

| Sacramento City Unified School District | 9/15/2023 | 3 | [Download](https://www.calstrs.com/files/66e62b885/EA23-28SacramentoCityUnifiedSchoolDistrictFinalReport.pdf) |

| Sylvan Union Elementary School District | 9/15/2023 | 1 | [Download](https://www.calstrs.com/files/23524be14/EA22-64SylvanUnionSchoolDistrictFinalReport.pdf) |

| Poway Unified School District | 9/6/2023 | 4 | [Download](https://www.calstrs.com/files/e50780012/EA23-30PowayUnifiedSchoolDistrictFinalReport.pdf) |

| Compass Charter Schools of Yolo | 9/6/2023 | 3 | [Download](https://www.calstrs.com/files/f8d5ecd9f/EA23-01CompassCharterSchoolsofYoloFinalReport.pdf) |

| Gonzales Unified School District | 9/6/2023 | 3 | [Download](https://www.calstrs.com/files/d44a754a5/EA22-113GonzalesUnifiedSchoolDistrictFinalReport.pdf) |

| Heartland Charter School | 9/6/2023 | 3 | [Download](https://www.calstrs.com/files/76e59ebc5/EA21-11HeartlandCharterSchoolFinalReport.pdf) |

| Dixon Unified School District | 9/6/2023 | 2 | [Download](https://www.calstrs.com/files/3a403a459/EA23-27DixonUnifiedSchoolDistrictFinalReport.pdf) |

| Fairfield-Suisun Unified School District | 9/1/2023 | 5 | [Download](https://www.calstrs.com/files/1b14ccbc0/EA22-29Fairfield-SuisunUnifiedSchoolDistrictFinalReport.pdf) |

| Bella Vista Elembentary School District | 9/1/2023 | 2 | [Download](https://www.calstrs.com/files/0745e250d/EA23-17BellaVistaElementarySchoolDistrictFinalReport.pdf) |

| Hollister School District | 8/29/2023 | 3 | [Download](https://www.calstrs.com/files/245ca53a5/EA23-07HollisterSchoolDistrictFinalReport.pdf) |

| Eastside Union School District | 8/29/2023 | 2 | [Download](https://www.calstrs.com/files/5e2184c37/EA22-101EastsideUnionSchoolDistrictFinalReport.pdf) |

| Santa Monica-Malibu Unified School District | 8/29/2023 | 2 | [Download](https://www.calstrs.com/files/1e8c88419/EA22-49SantaMonica-MalibuUnifiedSchoolDistrictFinalReport.pdf) |

| KIPP Los Angeles College Preparatory | 8/29/2023 | 1 | [Download](https://www.calstrs.com/files/c4e298edb/EA22-106KIPPLosAngelesCollegePreparatoryFinalReport.pdf) |

| Lakeside Union Elementary School District | 8/29/2023 | 1 | [Download](https://www.calstrs.com/files/64ff8efda/EA22-102LakesideUnionElementarySchoolDistrictFinalReport.pdf) |

| Richland School District | 8/29/2023 | 1 | [Download](https://www.calstrs.com/files/492a85fdf/EA23-06RichlandSchoolDistrictFinalReport.pdf) |

| Hayward Unified School District | 8/25/2023 | 5 | [Download](https://www.calstrs.com/files/bdf0301f2/EA22-39HaywardUnifiedSchoolDistrictFinalReport.pdf) |

| Helix Charter High School | 8/25/2023 | 3 | [Download](https://www.calstrs.com/files/2fe652ebd/EA22-98HelixCharterHighSchoolFinalReport.pdf) |

| Corning Union High School District | 8/25/2023 | 1 | [Download](https://www.calstrs.com/files/b25d89f61/EA23-08CorningUnionHighSchoolDistrictFinalReport.pdf) |

| Wallis Annenberg High School | 8/25/2023 | 1 | [Download](https://www.calstrs.com/files/e5d6ad0a6/EA22-80WallisAnnenbergHighSchoolFinalReport.pdf) |

| Kern County Superintendent of Schools | 8/22/2023 | 5 | [Download](https://www.calstrs.com/files/dac9c4b7e/EA20-28KernCountySuperintendentofSchoolsFinalReport.pdf) |

| Lucerne Valley Unified School District | 8/22/2023 | 1 | [Download](https://www.calstrs.com/files/b7364e7a0/EA22-95LucerneValleyUnifiedSchoolDistrictFinalReport.pdf) |

| Merced City School District | 8/22/2023 | 1 | [Download](https://www.calstrs.com/files/c97c7eceb/EA22-66MercedCitySchoolDistrictFinalReport.pdf) |

| San Diego Unified School District | 8/18/2023 | 4 | [Download](https://www.calstrs.com/files/aa34230aa/EA23-05SanDiegoUnifiedSchoolDistrictFinalReport.pdf) |

| Lamont Elementary School District | 8/18/2023 | 1 | [Download](https://www.calstrs.com/files/82108f604/EA22-90LamontElementarySchoolDistrictFinalReport.pdf) |

| Solana Beach School District | 8/18/2023 | 0 | [Download](https://www.calstrs.com/files/a640e1671/EA23-24SolanaBeachSchoolDistrictFinalReport.pdf) |

| New Opportunities Charter School | 8/15/2023 | 3 | [Download](https://www.calstrs.com/files/97f9f8b15/EA21-46NewOpportunitiesCharterSchoolFinalReport.pdf) |

| Sacramento County Office of Education | 8/4/2023 | 1 | [Download](https://www.calstrs.com/files/0905fc29e/EA22-76SacramentoCountyOfficeofEducationFinalReport.pdf) |

| West Kern Community College District | 8/4/2023 | 1 | [Download](https://www.calstrs.com/files/5eb293375/EA22-110WestKernCommunityCollegeDistrictFinalReport.pdf) |

| Healdsburg Unified School District | 8/2/2023 | 2 | [Download](https://www.calstrs.com/files/f659a2d9b/EA22-68HealdsburgUnifiedSchoolDistrictFinalReport.pdf) |

| San Lorenzo Unified School District | 7/28/2023 | 4 | [Download](https://www.calstrs.com/files/23d60c796/EA22-28SanLorenzoUnifiedSchoolDistrictFinalReport.pdf) |

| Los Rios Community College District | 7/28/2023 | 3 | [Download](https://www.calstrs.com/files/b702e8043/EA22-55LosRiosCommunityCollegeDistrictFinalReport.pdf) |

| Extera Public School #2 | 7/25/2023 | 2 | [Download](https://www.calstrs.com/files/21269c066/EA21-99ExteraPublicSchool2FinalReport.pdf) |

| Soulsbyville Elementary School | 7/25/2023 | 2 | [Download](https://www.calstrs.com/files/5a5885cb1/EA22-96SoulsbyvilleElementarySchoolFinalReport.pdf) |

| Covina-Valley Unified School District | 7/25/2023 | 1 | [Download](https://www.calstrs.com/files/c01d9aea6/EA22-77Covina-ValleyUnifiedSchoolDistrict.pdf) |

| Lake Elsinore Unified School District | 7/21/2023 | 3 | [Download](https://www.calstrs.com/files/12434d23a/EA22-75LakeElsinoreUnifiedSchoolDistrictFinalReport.pdf) |

| Mountain View Whisman School District | 7/21/2023 | 3 | [Download](https://www.calstrs.com/files/d52ae50f2/EA22-74MountainViewWhismanSchoolDistrictFinalReport.pdf) |

| Wheatland Elementary School District | 7/21/2023 | 3 | [Download](https://www.calstrs.com/files/d9393809d/EA22-72WheatlandElementarySchoolDistrictFinalReport.pdf) |

| Romoland Elementary School District | 7/21/2023 | 1 | [Download](https://www.calstrs.com/files/5a2ff6f66/EA22-103RomolandElementarySchoolDistrictFinalReport.pdf) |

| California Montessori Project - San Juan | 7/18/2023 | 3 | [Download](https://www.calstrs.com/files/be71bac9f/EA22-79CaliforniaMontessoriProjectSanJuanFinalReport.pdf) |

| La Mesa Spring Valley School District | 7/18/2023 | 0 | [Download](https://www.calstrs.com/files/63ae5669d/EA23-45LaMesa-SpringValleySchoolDistrictFinalReport.pdf) |

| Ceres Unified School District | 7/14/2023 | 0 | [Download](https://www.calstrs.com/files/f4e88a49c/EA23-42CeresUnifiedSchoolDistrictFinalReport.pdf) |

| Rosemead School District | 7/11/2023 | 4 | [Download](https://www.calstrs.com/files/4cb0fa0ed/EA22-19RosemeadSchoolDistrictFinalReport.pdf) |

| Durham Unified School District | 7/11/2023 | 1 | [Download](https://www.calstrs.com/files/89700e760/EA22-86DurhamUnifiedSchoolDistrictFinalReport.pdf) |

| Alhambra Unified School District | 7/5/2023 | 4 | [Download](https://www.calstrs.com/files/a53f7a523/EA22-58AlhambraUnifiedSchoolDistrictFinalReport.pdf) |

| Amador County Office of Education | 7/5/2023 | 2 | [Download](https://www.calstrs.com/files/dc5ac6b68/EA21-91AmadorCountyOfficeofEducationFinalReport.pdf) |

| Oak Grove School District | 6/22/2023 | 2 | [Download](https://www.calstrs.com/files/2c0108c12/EA22-57OakGroveSchoolDistrictFinalReport.pdf) |

| Paso Robles Joint Unified School District | 6/22/2023 | 1 | [Download](https://www.calstrs.com/files/51ce82205/EA22-87PasoRoblesJointUnifiedSchoolDistrictFinalReport.pdf) |

| Kings Canyon Joint Unified School District | 6/8/2023 | 0 | [Download](https://www.calstrs.com/files/aa19cf6a3/EA23-36KingsCanyonUnifiedSchoolDistrictFinalReport.pdf) |

| Eastern Sierra Unified School District | 6/6/2023 | 0 | [Download](https://www.calstrs.com/files/d7d96a769/EA23-09EasternSierraUnifiedSchoolDistrictFinalReport.pdf) |

| Mt. San Antonio College | 6/6/2023 | 0 | [Download](https://www.calstrs.com/files/e3dd4d7b3/EA23-19MtSanAntonioCollegeFinalReport.pdf) |

| Fullerton School District | 5/25/2023 | 1 | [Download](https://www.calstrs.com/files/c0c780dc5/EA22-56FullertonUSDFinalReport.pdf) |

| Placer Union High School District | 5/25/2023 | 1 | [Download](https://www.calstrs.com/files/db4ff8e75/EA22-32PlacerUnionHSFinalReport.pdf) |

| Corona-Norco Unified School District | 5/23/2023 | 11 | [Download](https://www.calstrs.com/files/4646a394e/EA20-17Corona-NorcoUSDFinalReport.pdf) |

| Extera Public School | 5/23/2023 | 4 | [Download](https://www.calstrs.com/files/1361a3c05/EA21-43ExteraPSFinalReport.pdf) |

| Thomas Edison Charter Academy | 5/19/2023 | 6 | [Download](https://www.calstrs.com/files/953b9962d/EA21-67ThomasEdisonCharterAcademyFinalReport.pdf) |

| Solano County Community College District | 5/12/2023 | 2 | [Download](https://www.calstrs.com/files/f553a3b93/EA22-62SolanoCountyCommunityCollegeDistrictFinalReport.pdf) |

| Westside Union School District | 5/12/2023 | 2 | [Download](https://www.calstrs.com/files/12db73c33/EA22-51WestsideUnionSchoolDistrictFinalReport.pdf) |

| Weaver Union School District | 5/12/2023 | 0 | [Download](https://www.calstrs.com/files/c8b9728da/EA22-94WeaverUnifionSchoolDistrictFinalReport.pdf) |

| North Valley Military Institute | 4/27/2023 | 2 | [Download](https://www.calstrs.com/files/4a8b23d94/EA21-102NorthValleyMilitaryInstituteFinalReport.pdf) |

| San Mateo Union High School District | 4/27/2023 | 2 | [Download](https://www.calstrs.com/files/58a49c3e9/EA22-69SanMateoUnionHighSchoolDistrictFinalReport.pdf) |

| California Montessori Project - Shingle Springs | 4/18/2023 | 3 | [Download](https://www.calstrs.com/files/593b1a2d5/EA22-11CaliforniaMontessoriProject-ShingleSpringsFinalReport.pdf) |

| Ramona Unified School District | 4/18/2023 | 2 | [Download](https://www.calstrs.com/files/345595027/EA22-78RamonaUnifiedSchoolDistrictFinalReport.pdf) |

| Lincoln Unified School District | 4/18/2023 | 0 | [Download](https://www.calstrs.com/files/47a92e236/EA22-46LincolnUnifiedSchoolDistrictFinalReport.pdf) |

| San Ysidro School District | 4/17/2023 | 2 | [Download](https://www.calstrs.com/files/f108e2a5d/EA22-71SanYsidroSchoolDistrictFinalReport.pdf) |

| Eureka Union School District | 4/14/2023 | 1 | [Download](https://www.calstrs.com/files/09520e9e4/EA22-60EurekaUnionSchoolDistrictFinalReport.pdf) |

| Hesperia Union School District | 4/14/2023 | 1 | [Download](https://www.calstrs.com/files/11ea995a5/EA22-63HesperiaUnifiedSchoolDistrictFinalReport.pdf) |

| Mountain View Elementary | 4/14/2023 | 1 | [Download](https://www.calstrs.com/files/4ce21e62b/EA22-31MountainViewElementaryFinalReport.pdf) |

| Newman-Crows Landing Unified School District | 4/14/2023 | 1 | [Download](https://www.calstrs.com/files/c18fbacbf/EA22-85Newman-CrowsLandingUnifiedSchoolDistrictFinalReport.pdf) |

| Scale Leadership Academy East | 4/11/2023 | 0 | [Download](https://www.calstrs.com/files/865c74e19/EA22-104ScaleLeadershipAcademyEastFinalReport.pdf) |

| Alisal Union School District | 4/5/2023 | 1 | [Download](https://www.calstrs.com/files/ca72045cc/EA22-03AlisalUnionSchoolDistrictFinalReport.pdf) |

| Lodi USD | 2/8/2023 | 0 | [Download](https://www.calstrs.com/files/d926aa61e/LodiUnifiedSDAudit-02-08-23.pdf) |

| Salida USD | 2/1/2023 | 0 | [Download](https://www.calstrs.com/files/7c51bcedd/SalidaUSDAudit-02-01-23.pdf) |

| Audeo Charter School | 1/11/2023 | 0 | [Download](https://www.calstrs.com/files/f3505e413/AudeoCharterSchoolAudit-01-11-23.pdf) |

| The Charter School of San Diego | 1/11/2023 | 0 | [Download](https://www.calstrs.com/files/6f3f79e16/CharterSchoolofSanDiegoAudit-01-11-23.pdf) |

Audits and Risk Management Committee

The Audits and Risk Management Committee of the Teachers’ Retirement Board meets three times a year in March, July and November. The committee is responsible for overseeing the employer audits process.

The March ARM Committee Audit Services Final Progress Report agenda item contains a list of employers audited in the previous calendar year. In this report, you’ll find information regarding common audit findings, employers who had audit findings affecting a population of members beyond those that were sampled—known as “systemic findings”—and the total number of members affected by systemic findings.

The July ARM Committee Internal Audit Plan Mid-Year Progress Report agenda item contains a list of employers that have been audited through the mid-year point.

The November ARM Committee contains the Annual Risk Assessment and Audit Plan for the upcoming calendar year, and the Audit Services Audit Plan Progress Report.