Diversity in the Management of Investments

CalSTRS is committed to setting best practice precedents, implementing innovative diversity and inclusion principles, motivating positive change, and advancing the world’s investment markets. We do this by establishing collaborative relationships across a vast network of investment managers, portfolio companies and industry associations in order to maximize returns and leverage opportunities for positive change.

For more information about CalSTRS emerging manager investments, refer to the following sections of the Diversity in the Management of Investments 2023 annual report:

Hosted by CalPERS and CalSTRS, the Catalyst: California’s Diverse Investment Manager Forum brought together institutional investors and other global allocators to meet and engage with diverse investor entrepreneurs and general partners to forge a new path in leadership and growth.

Catalyst took place June 27–28, 2023, at San Francisco Airport Marriott Waterfront in California.

At the event, we:

- Discussed the challenges in funding diverse talent

- Described how institutional investors and other global allocators can build a diverse emerging manager portfolio

- Paired institutional investors, global allocators, investor entrepreneurs and general partners for introductions and connections

- Shared insight and lessons learned from other investor entrepreneurs and general partners who overcame funding obstacles

Videos of the event

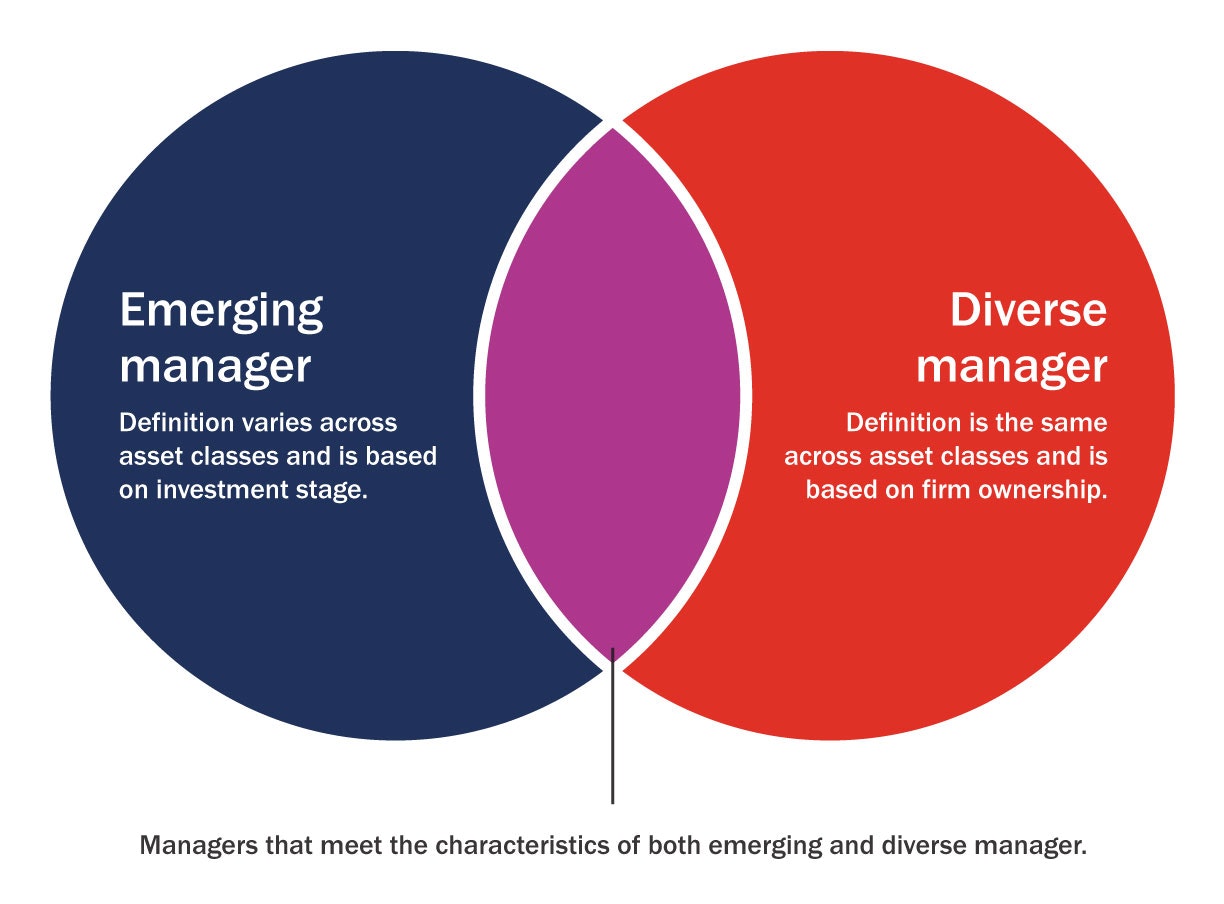

In October 2021, AB 890 (Cervantes) was signed into law. CalSTRS definitions of emerging manager, diverse manager and objective are as follows.

Emerging manager

Diverse manager

- Substantially diverse: A firm that is 25% to 49% owned by women, ethnic minority group, and/or a person of the LGBTQ+ community

- Majority diverse: A firm that is 50% or more owned by women, ethnic minority group, and/or a person of the LGBTQ+ community

- Ethnic minority group members include individuals who are African American, Asian American, Hispanic American, Native American, Pacific Islander, or other, and based on EEO-1 U.S. Census classifications. LGBTQ+ community members include people who identify as lesbian, gay, bi-sexual, transgender, or queer

Objective regarding the participation of emerging or diverse managers responsible for asset management within the system’s investment portfolio

- Consistent with its fiduciary duties, pursue and invest in emerging managers and diverse managers that generate performance that is aligned with the risk and return objectives of the applicable CalSTRS asset class