GASB 67/68 frequently asked questions

For accessible versions of files on this page, contact ADACoordinator@CalSTRS.com.

General information

Governmental Accounting Standards Board is an independent, non-profit, non-governmental regulatory body charged with setting authoritative standards of accounting and financial reporting for state and local governments, including school employers. GASB accounting standards are the primary source of Generally Accepted Accounting Principles for state and local governments (including CalSTRS and school employers).

GASB Statement No. 67 replaced the requirements of GASB Statement No. 25 and specifically affects pension plans like CalSTRS.

GASB Statement No. 68 replaced GASB Statement No. 27 and applies to employers who participate in pension plans, as well as entities that make contributions to pension plans (but are not actually employers). The most significant impact of these statements is that they change the way the liability for pensions is calculated and require employers and the state (as a non-employer contributing entity) to recognize a portion of the liability in their financial statements. Under the new standards, the Net Pension Liability recognized by employers could be very significant, affecting their credit ratings and ability to issue debt.

GASB 67 replaced the requirements of GASB 25, Financial Reporting for Defined Benefit Pension Plans and Note Disclosures for Defined Contribution Plans, and became effective for fiscal years beginning after June 15, 2013. CalSTRS implemented the requirements of GASB 67 in our financial statements for the fiscal year ended June 30, 2014.

GASB 68 replaced the requirements of GASB 27, Accounting for Pensions by State and Local Governmental Employers. This reporting requirement applies to the GAAP-based financial statements of employers and became effective for fiscal years beginning after June 15, 2014, or for the fiscal year ending June 30, 2015.

Per Education Code § 41010, all Local Educational Agencies are subject to the California School Accounting Manual, as approved by the State Board of Education and furnished by the Superintendent of Public Instruction. The California School Accounting Manual requires most school employers to prepare their financial statements in accordance with Generally Accepted Accounting Principles (GAAP). GASB standards, including GASB 68, are the primary source of GAAP for most school employers. Conformity with GAAP allows comparability among school employers. Being out of compliance with GAAP may impact the audit opinion of the school employer's financial statements.

Any participating employer that is a member of one of the state's defined benefit plans will have to implement GASB 68, including local governments, public authorities, local school systems. Not for profit Charter Schools that use the full-accrual basis of accounting may need to report these amounts in their fund statements.

No, GASB 67 and GASB 68 break the link between actuarial funding and financial accounting for pensions. Previous GASB standards required pension plans to calculate the annual required contribution (ARC) and report payments toward the ARC. This measured the plan's funding of the pension obligation. The new standards consider only how plans and employers account for and report pension costs.

The unfunded actuarial accrued liability (UAAL) was the pension liability calculated under the old standards. The UAAL was disclosed in the notes to CalSTRS financial statements, but it was not recorded in the CalSTRS, school employers', or the State of California's statement of net position. The UAAL was similar to the unfunded actuarial obligation in CalSTRS funding actuarial valuations for the Defined Benefit, Defined Benefit Supplement, and Cash Balance Benefit programs. The net pension liability (NPL) is the pension liability calculated under the new standards. The UAAL was presented separately for each program, while the NPL is calculated for the State Teachers' Retirement Plan as a whole.

GASB Statement Nos. 67 and 68 (new standards)

Total pension liability (TPL) - fiduciary net position = net pension liability (NPL)

GASB Statement Nos. 25 and 27 (old standards)

Actuarial accrued liability (AAL) - actuarial value of assets (AVA) = unfunded actuarial accrued liability (UAAL)

One significant change is that the new standards require the use of a 20-year municipal bond rate to discount future benefit payments past the point where the STRP net assets are exhausted. Discounting future cash flows to their present value is a widely used practice in the actuarial field, accounting, and finance that accounts for the time value of money and allows the measurement of future cash flows in today's dollars. The rate used to discount future cash flows to their present value is called the discount rate. There is an inverse relationship between the discount rate and the liability. In other words, the higher the discount rate used, the smaller the liability.

Under the previous standards the discount rate was equal to the assumed rate of future investment returns. Under the new standards, the assumed rate of return on investments can only be used up to the point in the future where the STRP has assets to pay benefits. After the point at which net assets are exhausted, a 20-year municipal bond rate must be used to discount future benefit payments. The 20-year municipal bond rate may be much lower than the assumed investment rate of return. For example, CalSTRS' assumed investment rate of return for the STRP was 7.1% (net of investment expenses) at June 30, 2023. However, the 20-year Bond Municipal General Obligation Index from Bondbuyer.com had a yield of 3.65% at the same date.

The single discount rate that combines the assumed investment rate of return with the 20-year municipal bond rate is referred to as a blended discount rate. If the 20-year municipal bond rate is lower than the assumed investment rate of return and a blended discount rate is required, then the blended discount rate will be lower than the assumed investment rate of return. Benefit payments are projected more than 30 years into the future, so small changes in the discount rate can have a large impact on the pension liability.

In addition to the change in the guidance on the discount rate, the calculation of the NPL uses the market value of assets instead of the actuarial value of assets. The actuarial value of assets smoothed investment gains and losses over three years, whereas the investment gains and losses are recognized immediately in the market values of assets. The market value of assets is more volatile than the smoothed actuarial value of assets; therefore, it makes the NPL more volatile than the UAAL.

An analysis of future cash flows including contributions, investment returns, administrative expenses, and benefit payments was performed by CalSTRS external actuary. The actuary determined that CalSTRS assets will be sufficient to pay all future benefit payments. Therefore, a blended discount rate was not used to calculate the NPL at June 30, 2023 and the assumed investment rate of return, gross of administrative expenses, was used to discount all future benefits.

No. Statutory contribution rates for participating State Teachers' Retirement Plan employers are determined by the legislature, which has given the Teachers' Retirement Board limited authority to adjust the supplemental employer contribution rate from July 1, 2021 through June 2046 in order to eliminate the remaining unfunded actuarial obligation related to service credited to members prior to July 1, 2014.

No. The NPL is an accrual accounting measurement calculated in conformity with GASB 67 and GASB 68. The unfunded liability is a funding measure calculated according to Actuarial Standards of Practice.

The purpose of the NPL is to comply with GASB's financial reporting requirements, while the intent of the unfunded liability for CalSTRS programs is to provide useful information for policy makers in setting contribution rates. The GASB standards do not render a useful figure for governments or entities struggling with how to address unfunded pension liabilities.

In fact, GASB has communicated that it does not intend for policy makers to use the new accounting requirements as part of the governmental budget process. CalSTRS will continue to have separate actuarial valuations performed to calculate the unfunded liability of the Defined Benefit, Defined Benefit Supplement and Cash Balance Benefit programs.

Net Pension Liability

The net pension liability for the State Teachers' Retirement Plan as of June 30, 2023, is $76,161 million.

The STRP includes the following programs—Defined Benefit, Defined Benefit Supplement, Cash Balance Benefit, Teachers' Replacement Benefit, and Purchasing Power Protection. As of June 30, 2023, the Defined Benefit program made up about 94% of the net assets of the STRP, with the other programs making up the other 6%.

CalSTRS has determined that, for accounting purposes, the Defined Benefit, Defined Benefit Supplement, Cash Balance Benefit, Teachers' Replacement Benefit, and Purchasing Power Protection programs are all part of a single plan—the State Teachers' Retirement Plan. GASB 67 requires financial statements be presented by plan, not program. A single plan exists if all assets accumulated in a defined benefit pension plan for benefit payments may legally be used to pay benefits to any plan members, regardless of whether separate actuarial valuations are performed or reserves maintained for specific groups of members.

GASB 67 indicates that one criteria for determining whether a separate plan exists is whether there is more than one class or group of public employees involved. Examples of different classes of employees are public safety, judges, legislators, and miscellaneous. CalSTRS members are all teachers and school administrators. This homogeneity implies that a single class, and therefore a single plan, exists.

The net pension liability is presented in multiple places in the financial statements.

Page references are for the fiscal year 2022-23 Annual Comprehensive Financial Report:

- p. 52 – Note 3 (Net pension liability of employers and nonemployer contributing entity)

- p. 78 – Schedule I (Schedule of changes in net pension liability of employers and nonemployer contributing entity)

- p. 80 – Schedule II (Schedule of net pension liability of employers and nonemployer contributing entity)

Page references are for the fiscal year 2022-23 Other Pension Information

- p. 48 – Schedule B (Schedule of aggregate pension amounts for employers and nonemployer contributing entity)

Deferred inflows and outflows of resources and pension expense are presented on p. 48 within Schedule B.

CalSTRS calculates NPL by subtracting State Teachers’ Retirement Plan fiduciary net position from total pension liability for STRP. Please refer to Note 3 of the Basic Financial Statements (p. 52) and Schedule I (Schedule of changes in net pension liability of employers and nonemployer contributing entity) of the Required Supplementary Information (p. 78) within CalSTRS' fiscal year 2022-23 Annual Comprehensive Financial Report.

No, the NPL is an accrued liability, similar to accrued vacation or other employment benefits that have been earned by employees, but are payable sometime in the future. Contribution rates are set in statute and there is currently no mechanism for employers to make contributions in addition to those required by law. Therefore, school employers have no mechanism for reducing their liability directly. Only by reducing the NPL for the State Teachers' Retirement Plan as a whole can the pension liabilities of individual school employers be reduced.

Legislation enacted on June 24, 2014, in Chapter 47, Statutes of 2014 (Assembly Bill 1469-Bonta) fully funds the CalSTRS Defined Benefit Program by 2046 through shared contribution increases among the program's three contributors: CalSTRS members, school district employers and the State of California. With the enactment of AB 1469, actuarial projections now indicate that assets are not projected to be depleted, and will be sufficient to pay benefits in future years. Thus, CalSTRS is not required to use the blended discount rate under the GASB standards.

Read more information about AB 1469.

Proportionate share calculation

Schedule A (Schedule of proportionate share of contributions for employers and nonemployer contributing entity) on p. 4 through p. 47 of CalSTRS fiscal year 2022-23 Other Pension Information. The schedule shows each employer’s contributions to the nearest dollar as calculated by CalSTRS for fiscal year 2022-23. It also shows the corresponding contributions as a percentage of total employer contributions for the year. The percentage is displayed to three decimal places, which is five decimal places in whole numbers. This is an important point to remember when using the proportionate share to calculate your school employer’s portion of the NPL.

The schedule is organized by the County Office of Education through which employers report their contributions. Employers within each COE are listed by their 5-digit employer reporting numbers. Some employers report their Defined Benefit program contributions through their COE, but their Cash Balance Benefit program contributions separately. Those employers appear twice on the Schedule A and should add all of their contributions together to determine their proportionate share of State Teachers’ Retirement Plan contributions. Otherwise, they will understate their proportionate share and their portion of the NPL.

Yes, a separate audit opinion was issued on Schedule A and the Schedule of aggregate pension amounts for employers and nonemployer contributing entities (Schedule B), and is located at the beginning of the section titled “Other Pension Information—State Teachers’ Retirement Plan” on p. 1 of CalSTRS fiscal year 2022-23 Other Pension Information.

CalSTRS' external auditor performed testing at a sample of school employers in the spring and summer of 2023 in order to render an opinion on the schedule of proportionate share. Specifically, they tested active member census data and payroll information at approximately 100 school employers.

CalSTRS external auditor will perform this audit work annually. Your school employer’s external auditor may choose to rely on the audit opinion of CalSTRS external auditor to support their opinion on the school employer’s financial statements.

CalSTRS calculates current year contributions due based on current year creditable earnings for active members as reported by employers. Since cash remittances of contributions due are received from employers prior to reports of creditable earnings by member, CalSTRS accrues employer contributions due monthly based on estimates. In addition, CalSTRS recognizes contributions and adjustments to contributions reported in the current year for service performed in a prior year as they are reported by employers.

The specific types of contributions included are:

- Monthly contributions, including accruals, to the Defined Benefit program for the CalSTRS 2% at 60 under Education Code §§ 22950 and 22951

- Monthly contributions, including accruals, to the Defined Benefit program for the CalSTRS 2% at 62 formula under Government Code § 7522.30

- Excess service contributions, including accruals, to the Defined Benefit Supplement program under Education Code § 22905(b)(1)

- Employer contributions to the Cash Balance Benefit program under Education Code §§ 26503 and 26503.5

- Employer contributions to the Defined Benefit Supplement program for limited-term compensation increases under Education Code § 22905(b)(3)

- Employer contributions for members who participate in the reduced workload program under Education Code § 22713(e)

- Employer contributions for members which serve as an elected officer in an employee organization under Education Code § 22711(a)(3)

- Employer contributions redirected to the Medicare Premium Payment program under Education Code § 22950(c)

- Employer contributions redirected to the Teachers' Replacement Benefits program under Education Code § 24260(d)

CalSTRS excluded the following contributions from Schedule A because they are separately financed obligations paid in installments, or do not reflect the employers' long-term contribution effort:

- Employer contributions to the Supplemental Benefit Maintenance Account and the Defined Benefit program for retirement incentives (golden handshake) under Education Code §§ 22714 and 22715

- Employer contributions for the purchase of one-year final compensation under Education Code § 22135(f)

- Employer contributions for service credit awarded for excess unused sick leave under Education Code § 22718

- Employer contributions for additional service credit under Education Code § 22801(d)

- Employer contributions for military service credit under Education Code § 22852

No, school employers are not required by the new accounting standards to use the proportionate share calculated by CalSTRS. According to GASB 68, the basis for the employer's portion of the net pension liability, pension expense and deferred items should be consistent with the manner in which contributions to the State Teachers' Retirement Plan are determined.

However, GASB 68 does not specify exactly who is responsible for calculating the employer's proportionate share of contributions. CalSTRS has decided to provide this information as a courtesy to our employers to assist them in implementing GASB 68. School employers may calculate their own proportionate share using a different methodology than CalSTRS. One advantage to using CalSTRS calculation is that it has been audited.

To help employers understand the amount presented for their school district in the Schedule of proportionate share (Schedule A), CalSTRS has provided a Reconciliation of Employer Contributions report through the Contributions Account Portal. To get to the report, school employers must log into the Secure Employer Website and then follow this path:

Contribution Account Portal ➤ Financial Reporting ➤ Reconciliation of Employer Contributions

There is a job aid on the ‘Help' page on the Contributions Account Portal that explains in detail how to run the report. A link to the job aid is also posted on CalSTRS.com.

Download Reconciliation of Employer Contributions job aidThe Reconciliation of Employer Contributions report reconciles contributions presented in the schedule of proportionate share (Schedule A) to contribution reports submitted by employers. The amounts in the report should align with monthly contribution settlement information currently provided through the CAP.

The Contributions Account Portal can only be accessed through the Secure Employer Website. Each County Office of Education has a SEW administrator. Contact your COE and ask them who is the SEW administrator and what the process is to get access to SEW and the Contributions Account Portal.

Deferred inflows/outflows

Deferred inflows and outflows of resources are a relatively new accounting concept. A traditional balance sheet consists of assets and liabilities; however, GASB felt these categories were insufficient to describe certain transactions and therefore, two new categories were needed. GASB first introduced the idea of deferred inflows and outflows of resources in Concepts Statement No. 4, which defines deferred outflows of resources as a consumption of net assets that is applicable to a future reporting period. Concepts Statement No. 4 defines deferred inflows of resources as an acquisition of net assets that is applicable to a future reporting period. Deferred outflows of resources have a positive effect on net position, similar to assets, and deferred inflows of resources have a negative effect on net position, similar to liabilities. Typically, when assets and liabilities are recorded they have a corresponding revenue or expense that is recognized in the current period, whereas when deferred items are recorded the expense or revenue will be recognized in future periods, similar to a prepaid expense or deferred revenue.

In GASB 68, the following items are defined as deferred inflows and outflows:

- Differences between expected and actual experience*

- Changes in assumptions

- Difference between projected and actual earnings on plan investments

- Changes in proportionate share

- Contributions subsequent to the measurement date

- Difference between an employer's proportionate share and actual contributions

* Also referred to as actuarial gains and losses

Instead of being recognized in pension expense in the current period, the change in net pension liability related to the items above is recognized as pension expense in future periods as these items are amortized.

The amortization period for the difference between projected and actual earnings on plan investments is five years. The amortization period for all other deferred items is the average remaining service life of plan members. The average remaining service life of plan members includes active members and retirees, whose remaining service life is zero, but excludes inactive members.

Except for the difference between projected and actual earnings on plan investments, deferred inflows and outflows must be separately recognized and amortized in the financial statements. They cannot be netted together. For example, if there is a deferred outflow of resources of $200 and a deferred inflow of resources of $500 related to changes in assumptions, they cannot be combined and shown on the balance sheet as a $300 net deferred inflow of resources for changes in assumptions. However, deferred inflows and outflows for the difference between projected and actual earnings on plan investments is an exception and can be netted together.

CalSTRS calculated the average remaining service life of STRP members at June 30, 2023, to be 7 years. This is disclosed in a footnote on p. 48 in the schedule of aggregate pension amounts (Schedule B) in CalSTRS fiscal year 2022-23 Other Pension Information. School employers are not required to use the average remaining service life of STRP members calculated by CalSTRS and may use their own calculation instead.

CalSTRS will maintain schedules for deferred outflows of resources and deferred inflows of resources at the collective level. However, employers will need to maintain schedules for deferrals arising from changes in the employer's proportionate share and contributions subsequent to the measurement date. The reasoning behind this approach is that CalSTRS is not calculating deferrals specific to individual school employers.

Under GASB 71, Pension Transition for Contributions Made Subsequent to the Measurement Date – an amendment of GASB Statement No. 68, if a school employer chooses a measurement date of June 30, 2023, then cash contributions subsequent to that date should be recorded as a deferred outflow of resources.

On-behalf contributions

On-behalf contributions refer to the contributions made by the State of California (the “State”), pursuant to Sections 22954 and 22955.1 of the Education Code and Public Resources Code Section 6217.5, to CalSTRS on behalf of Local Educational Agencies members or school employers.

GASB 68 refers to this as a special funding situation which occurs when a nonemployer entity (the State) is legally responsible for making contributions directly to a pension plan that is used to provide pensions to the employees of another entity or entities and either of the following conditions exists:

- The amount of contributions for which the nonemployer entity is legally responsible is not dependent upon one or more events or circumstances unrelated to the pensions.

- The nonemployer entity is the only entity with a legal obligation to make contributions directly to a pension plan.

The accounting treatment for on-behalf payments for cost-sharing employers in a special funding situation (such as CalSTRS employers) depends on the measurement focus and basis of accounting applicable when preparing financial statements. That is, whether the financial statements are prepared based on an economic resources measurement focus and accrual basis of accounting or based on a current financial resources measurement focus and modified accrual basis of accounting.

Prior to the issuance of GASB 68, recognition and measurement of on-behalf payments were included in GASB 24, Accounting and Financial Reporting for Certain Grants and Other Financial Assistance.

While GASB 68 provides the guidance for the recognition and measurement of the effects of on-behalf payments in financial statements prepared using the economic resources measurement focus and accrual basis of accounting, it did not provide guidance for financial statements prepared using the current financial resources measurement focus and modified accrual basis of accounting.

Accordingly, GASB issued Statement No. 85, Omnibus 2017, (GASB 85) which addressed several topics including guidance on the recognition and measurement of on-behalf payments in financial statements prepared using the current financial resources measurement focus and modified accrual basis of accounting.

For financial statements prepared using the economic resources measurement focus and accrual basis of accounting, cost-sharing employers in a special funding situation (which is the case for CalSTRS employers) are required to account for on-behalf payments in accordance with GASB 68. Based on the guidance in paragraphs 94 and 95 of GASB 68, employer should:

- Recognize pension expense for the State's proportionate share of the STRP collective pension expense that is associated with each respective employer.

- Recognize revenue in an amount equal to the expense recognized for the State's proportionate share of the STRP collective pension expense.

The amount recognized as on-behalf contributions when preparing financial statements using the economic measurement focus and accrual basis is based on the collective pension expense of the State. Below is a mock illustration of the calculations to perform to determine on-behalf payments for a school employer (Employer X) in accordance with the guidance in GASB 68.

Employer reporting year is FY 2023-24.

Reports to use:

- FY 2022-23 Annual Comprehensive Financial Report

- FY 2022-23 Other Pension Information

Determine the collective pension expense (or pension credit if calculated amount is negative) for FY 2023-24 using the information on the schedule of aggregate pension amounts for employers and nonemployer contributing (Schedule B) of CalSTRS' FY 2022-23 OPI report:

| Change in NPL recognized immediately in pension expense (credit) | ($1,839,000,000) |

|---|---|

| Add: total current year reduction of deferred outflows | $4,060,000,000 |

| Less: total current year reduction of deferred inflows | $3,327,000,000 |

| STRP collective pension expense (credit)* | ($1,106,000,000) |

* The STRP pension expense (credit) calculated here is in accordance with GASB 68, paragraph 102, and does not include each employer's current year recognition of amounts deferred for:

- Change in employer proportionate share

- Employer contributions during measurement period

- Employer contributions subsequent to measurement period

Determine the State proportionate share using Schedule A of the OPI. Total contributions for the State are $3,719,874,320 and its proportionate share of total CalSTRS-calculated employer contributions is 32.393%

Accordingly, the State share of the collective pension expense (credit) of the STRP is ($358,266,580) and calculated as follows:

| [A] | STRP pension expense (credit) | ($1,106,000,000) |

|---|---|---|

| [B] | State proportionate share as of STRP pension expense (credit) | 32.393% |

| [A] x [B] | State proportionate share of pension expense (credit) | ($358,266,580) |

Calculate the proportionate share of Employer X in relation to other employers (i.e. not including the State) based on information in Schedule A of the OPI. The calculated proportionate share percent as presented in Schedule A is based on total contributions (Employers + State) but for purposes of calculating Employer X's proportion of the State proportionate share of the collective pension expense (credit), the rate should be based on total calculated and allocated employer contributions.

| [A] | FY 2022-23 Employer X total calculated and allocated contributions | $10,204,085 |

|---|---|---|

| [B] | Total calculated employer contributions for FY 2022-23 | $7,763,840,536 |

| [A] / [B] | Recalculated proportionate share % based on total employer contributions | 0.131% |

Determine the State proportionate share of the collective pension expense (credit) that is associated with Employer X:

| [A] | Rate to calculate State proportionate share of the collective pension expense (credit) that is associated with Employer X | 0.131% |

|---|---|---|

| [B] | State proportionate share of STRP collective pension expense (credit) | ($358,266,580) |

| [A] x [B] | State proportionate share of the collective pension expense (credit) and revenue that is associated with Employer X | ($470,873) |

Employer X will record pension expense (credit) of ($470,873) for its share of the State’s share of the collective pension expense (credit) and corresponding revenues for the support (on-behalf payment) from the State.

The example above is one way of determining an employer's share of State on-behalf contributions, however; different calculations will yield different results. Therefore, it is recommended that each school employers come up with their own policy in estimating their on-behalf contributions from the State of California.

Although the information contained herein may help employers contributing to the STRP with the calculation and preparation of journal entries for financial reporting required by GASB 68, it has no authoritative status.

CalSTRS is not rendering legal or accounting advice with this publication but rather is providing additional instruction as to how an employer may choose to use the information published by CalSTRS in calculating on-behalf contributions.

It is recommended that the users of this information refer to GASB 68, the Guide to Implementation of GASB 68, their accounting policies, their external auditor, and other experts as appropriate to assist with their implementation.

For financial statements prepared using the current financial resources measurement focus and modified accrual basis of accounting, cost-sharing employers in a special funding situation (which is the case for CalSTRS employers) are required to recognize the following per paragraphs 9 and 10 of GASB 85:

- Expenditures for on-behalf payments for pensions equal to the total of the amounts paid during the reporting period by the State to the STRP.

- Revenue equal to the amount of expenditures determined as noted above.

Employers preparing financial statements using the current financial resources measurement focus and modified accrual basis of accounting will report a proportionate share of contributions made by the State of California (State) during their reporting period. To perform the calculation, employers will need to determine their proportionate share of contributions in relation to other employers in addition to the amounts contributed by the State during their fiscal year.

State contributions to CalSTRS pursuant to Sections 22954 and 22955.1 of the Education Code and Public Resources Code Section 6217.5 for fiscal year 2023-24 are as follows:

| General Fund Contributions (Ed. Code Section 22955.1) | $3,084,873,614 |

|---|---|

| Supplemental Benefit Maintenance Account Contributions (Ed. Code Section 22954) | $854,054,759 |

| School Lands Revenue (Public Resources Code Section 6217.5) | $7,161,011* |

| Total FY 2023-24 State Contributions | $3,946,089,384 |

* The estimated amount of School Land contributions as provided by the California State Lands Commission.

Mock calculation

This is a mock illustration of the calculations to perform to determine on-behalf payments for a school employer (Employer X) in accordance with GASB 85. This example is based on fiscal year 2023-24.

- Employer reporting year is FY 2023-24.

- CalSTRS reports to use: FY 2022-23 Other Pension Information (OPI).

Calculate the proportionate share of Employer X in relation to other employers (i.e. not including the State) based on information in Schedule A of the OPI. The calculated proportionate share percent as presented in Schedule A is based on total contributions (Employers + State) but for purposes of calculating proportionate share of on-behalf contributions, the percent should be based on total calculated and allocated employer contributions.

| [A] | FY 2022-23 Employer X total calculated and allocated contributions | $10,204,085 |

|---|---|---|

| [B] | Total calculated employer contributions for FY 2022-23 | $7,763,840,536 |

| [A] / [B] | Recalculated proportionate share % based on total employer contributions | 0.131% |

Calculate Employer X's share of on-behalf contributions.

| [A] | FY 2023-24 State contributions | $3,946,089,384 |

|---|---|---|

| [B] | Recalculated proportionate share % based on total employer contributions | 0.131% |

| [A] x [B] | On-behalf contributions for FY 2022-23 | $5,169,377 |

Employer X will record pension expense (credit) of $5,169,377 for its share of the State’s contribution to the STRP and corresponding revenues for the support (on-behalf payment) from the State.

The example above is one way of determining an employer's share of State on-behalf contributions, however; different calculations will yield different results. Therefore, it is recommended that each school employers come up with their own policy in estimating their on-behalf contributions from the State of California.

Although the information contained herein may help employers contributing to the STRP with the calculation and preparation of journal entries for financial reporting required by GASB 68, it has no authoritative status.

CalSTRS is not rendering legal or accounting advice with this publication but rather is providing additional instruction as to how an employer may choose to use the information published by CalSTRS in calculating on-behalf contributions.

It is recommended that the users of this information refer to GASB 85, their accounting policies, their external auditor, and other experts as appropriate to assist with their implementation.

Reporting

Yes, changes resulting from GASB 68 requirements apply only to the government-wide financial statements, enterprise and agency funds where financial statements are prepared on full accrual basis of accounting.

The measurement date is the date the net pension liability is measured for purposes of a school employer's financial reporting and must be consistently applied from period to period. Because the NPL is reported by CalSTRS, the measurement date must fall on June 30, CalSTRS fiscal year end.*

However, school employers can choose to use June 30 of the current fiscal year or June 30 of the prior fiscal year as the measurement date. For example, for their financial statements for the fiscal year ending June 30, 2023, school employers can use June 30, 2022, or June 30, 2023, for their measurement date.

When selecting the measurement date, school employers should consider when CalSTRS financial statements will be available in relation to when the employer plans to complete their own financial statements. Employers who choose to use June 30 of the current fiscal year as their measurement date should consider that CalSTRS June 30, 2023, financial statements will not be available until November 2023.

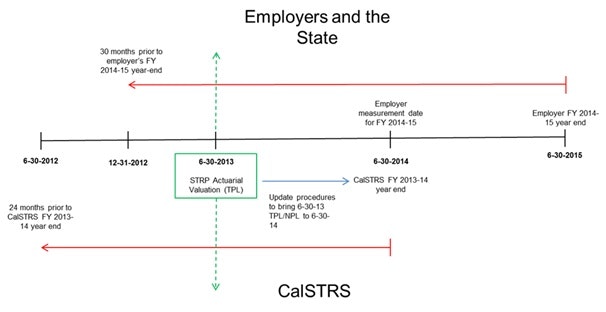

The diagram below reflects the timing of the STRP actuarial valuation and the selection of a June 30, 2013, measurement date for an employer's FY 2014-15 financial statements:

* June 30 is also the fiscal year end for school employers, per the Department of Education's California School Accounting manual

CalSTRS fiscal year 2022-23 financial statements, which are within the Annual Comprehensive Financial Report, are available on CalSTRS.com.

CalSTRS audited June 30 financial statements are approved annually by the Teachers’ Retirement Board in November and posted to CalSTRS.com in late December upon completion of the Annual Comprehensive Financial Report.

CalSTRS presents our assumed rate of return in Note 3 of the “Notes to the Basic Financial Statements” section p. 52 of CalSTRS fiscal year 2022-23 Annual Comprehensive Financial Report. The assumed rate of return is an actuarial assumption and is derived net of investments expenses, but gross of administrative expenses.

GASB 68 paragraphs 74-82 describe the required note disclosures and supplementary schedules for cost-sharing employers. Unfortunately, CalSTRS cannot assist employers in preparing this information as it falls outside the scope of CalSTRS fiduciary duty to our members.

Additional information

Some large school employers will be audited every year, while smaller employers will be selected on a less frequent basis. The nature and the extent of the work performed by CalSTRS external auditor is solely for the purposes of the audit of CalSTRS' financial statements and Schedule of proportionate share and is not related to or a substitute for any audits conducted independently by CalSTRS' Audit Services or an employer's external auditors.

Please refer to GASB 68 Educational Material. School employers also should work with their external auditors to implement GASB 68.

Download GASB 68 Educational MaterialNo. CalSTRS OPEB plan is reported in the Teachers' Health Benefits Fund. Postemployment healthcare benefits and termination benefits are classified as other postemployment benefits (OPEB) in accounting standards. OPEB are excluded from the scope of GASB 67 and GASB 68 and currently fall under GASB 74 and GASB 75.

CalSTRS cannot give specific accounting advice or guidance to employers, but for questions about GASB 67 and GASB 68, email FinancialReporting@CalSTRS.com.